Written by: Angela Akers

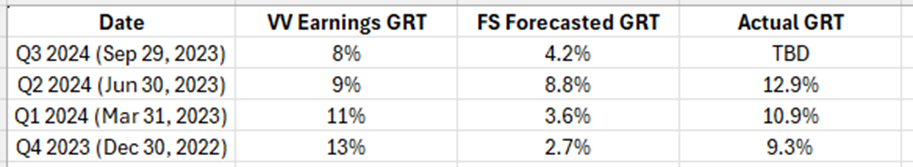

A couple of weeks ago, October 11, 2024, I wrote an Essay entitled, “An Understanding Of Earnings Growth.” In the Essay, I compared the VectorVest GRT forecast for the S&P 500 to the FactSet Earnings Growth and the actual growth.

As a reminder, VectorVest Earnings Growth (GRT) reflects a one to three year forecasted earnings growth rate in percentage per year and is calculated from historical, current and forecasted earnings data. Here is the table from that Essay:

As you can see, the VectorVest forecast was much closer to the actual earnings growth than the FactSet projections.

This got my gears turning. What would happen if I just picked the strongest growth stocks, as ranked by GRT Desc., in the Major Indices using the quarterly dates above and held them? Would this buy and hold strategy be able to beat the Indices’ gains during the same period? How would the high GRT stocks perform overall during the up and down periods of volatility over the last 22 months?

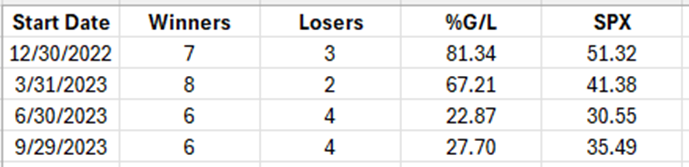

To answer these questions, I turned to the WatchList Viewer and the QuickTest tool. First, I opened the S&P500 WatchList and sorted it by GRT Desc and QuickTested the Top 10 from each of the dates above to last night’s close. Here is what I found:

Okay, according to my test, the fastest growing stocks in the S&P500 beat the overall performance of the index 50% of the time, by a pretty healthy clip. In the two “losing” scenarios, gains were comparable to the index gains and, in all cases, there were more winners than losers. I will continue to watch these as I do believe that it’s no coincidence that it was the two most recent tests that the SPX beat, even if it was by a relatively nominal percentage. As you all know, VectorVest is a trend system and most good trading systems need time for the trends to fully develop and perform. So, it will be interesting to see if these tests end up outperforming the S&P as well, given just a bit more time.

Next, I repeated the tests for the Dow Jones Industrials:

The fastest growing stocks were able to beat the overall performance of the DJI 75% of the time.

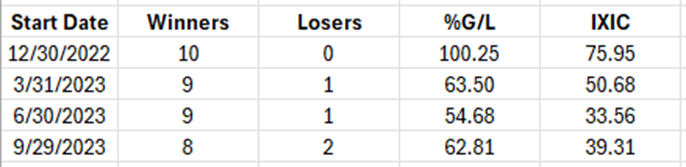

Finally, I repeated the tests for the Nasdaq 100:

The fastest growing stocks were able to beat the overall performance of the IXIC 100% of the time.

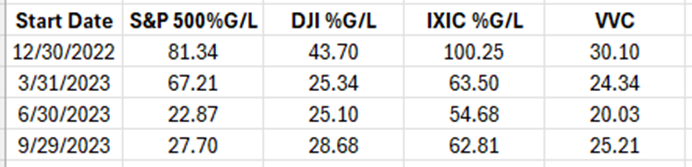

Incidentally, in all 12 tests listed above, the top GRT % gains in each of the Major Indices beat the market as a whole, as represented by the Price of the VectorVest Composite (VVC).

Dr. DiLiddo referred to earnings growth as “The Golden Touch” and dedicated an entire Chapter to it in his classic little green book, “Stock, Strategies & Common Sense.” He staunchly believed that one of the keys to preserving and increasing your wealth was to build a portfolio of consistent and predictable growth stocks and believed it was also the surest way to conquer the effects of inflation and interest rates.

In all of the above tests, these goals would have been easily accomplished (by a landslide), lending support to Dr. DiLiddo’s Belief.

PS. The Primary Wave turned Dn this week and, while the downturn has not yet been confirmed, it’s a good time to be proactive and get a refresher on how to make money in a downtrending market. Mr. Jerry D’Ambrosio will help you in this week’s “Special Presentation.”

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment