Hi everyone,

I am most pleased to announce the winners today!

A reminder – the prizes are as follows – to be paid to the user group leader for use towards the respective user group.

First Place $500 USD

Second Place $250 USD

Third Place $150 USD

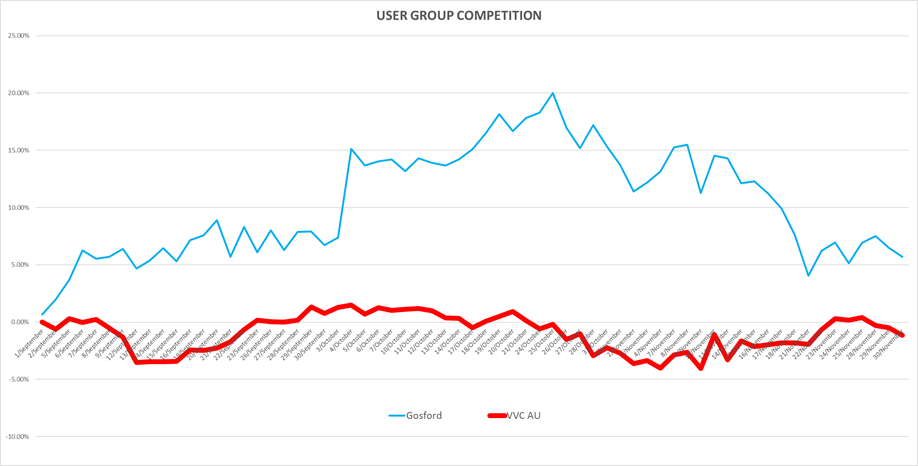

Before I announce the winners, let’s consider what the market did from 1 September – 30 November – for the competition period.

The VVC/AU achieved -1.16% over this period. It would be fair to say that there was a lot of market volatility leading up to the US elections. This made the competition challenging and really brought home the power of prudent risk management.

In First place: the winning entry came from Richard Savage and his team in Gosford! The portfolio got to 20.01% on the 25th of October but as the market slowed down leading up to the US election it pulled back- had this competition run for a few more days – it most likely would be rocketing away again. The winning portfolio used our most aggressive timing signal -that being the Primary Wave. In addition, Richard and the team gave the portfolio plenty of room to breathe with a 38% Gain and a 10% loss for the stop loss. I have seen time and time again in Australia – some of our most successful portfolios use wider stop losses (such as the Worry Free Portfolio and the SMSF Balanced Portfolio). Well done to the Richard and his members. Here is a snapshot of the winning portfolio as benchmarked against the VVC/AU (the VectorVest Australia composite)

In Second Place: Edward Popham and his team from Town Hall – Sydney. For 95% of the time – the portfolio sat in cash – however, don’t forget cash is a position too! When we reflect back upon the market period from 1 September to 30 November – using the GLB/RT Kicker – we can see that the GLB/RT Kicker would have kept us out of the market for most of that time per the graph below:

The strategy paid off, the portfolio remained in cash for most of the competition since no stocks were elected upfront – and it held the capital together very tightly until it was time to launch for a sprint to the finish. GLB/RT Kicker again proves the value of this powerful market timing signal.

In Third Place – picking up 150USD for his user group is Chris Boast and the team from Adelaide. The portfolio started off strong due to some great stock picks to kick off the portfolio – however, since it was applying the GLB/RT Kicker timing signal, once the stocks had been stopped out – the portfolio effectively went into a holding pattern – as per 2nd place – certainly not a bad move in the volatile period. Had it been a few more days – this portfolio would have been strongly challenging 2nd place.

Special mention must go to Alan’s team in Melbourne – the team from Melbourne’s portfolio was flying around mid-October – moving up over 11% – then the portfolio took a breather – but I see that it is starting to fire up again now that the market is starting to pick up. Had the market been surging Alan – no doubt your portfolio would have been right up there – it was a portfolio built for calmer waters geared for the up swings.

Overall, this was a test competition to see what worked and what did not work. We will look to expand this competition next year – where the user group is actively able to modify and tinker the portfolio each day if required. I am thinking through the logistics of doing this. Also, I will look to offer shorting in the next competition – as had we allowed for going long and short – no doubt this would have produced some explosive results with the on the down swings through shorting.

I will be touch with the winners early next week to arrange payment to the user respective user groups.

Thanks again everyone for your commitment and interest in the competition. Let’s make the next one even better.

If I do not speak to you before the break – have a great festive season and speak to you all in the new year!

Regards,

Russell.

Hi Russell,

congratulations to the winners, will you give up the winners trading plan for all to see?