URANIUM SPOT PRICES ARE SURGING!

Uranium spot prices are on a tear! Prices are up over 80% in the last 12 months with the price at $92 USD per pound as of the end of mid-January 2024. What is behind the rise in uranium prices?

Cameco Corporation (US ticker code CCJ), a major producer of uranium, attributes the rise to supply constraints. CCJ cut its production forecast from 18 million pounds of uranium concentrate to 16.3 million pounds. Further compounding issues are the war in Ukraine impacting uranium mining in Russia. The unrest in Niger has also affected supply–Niger is the 6th largest world producer of uranium.

A further factor impacting the spot uranium price is demand from countries considering nuclear to achieve energy security. One recent example was news of France committing to build 6 new nuclear reactors by 2050.

With rising spot prices, well positioned uranium stocks and ETFs are benefitting.

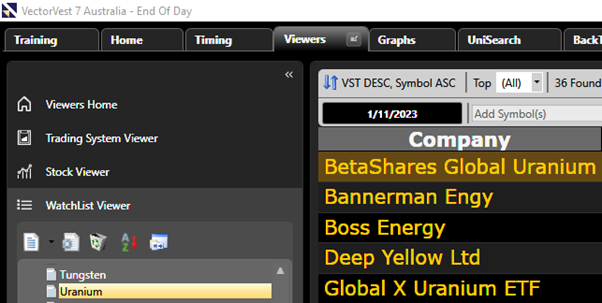

Let’s use VectorVest to help us find these stocks and ETFs. In the VectorVest system, there is a WatchList entitled: Uranium. This allows our subscribers to check out Uranium stocks with the best combination of fundamentals and technicals each day.

Here is a snapshot as of 2 January 2024 where any stock associated with Uranium is identified and then sorted by the best combination of fundamentals at the top of the list:

The performance of the top ranked Uranium Stocks from 1 January 2024 through to 17th of January 2024 is as follows:

A word of caution: most of the Uranium stocks in the WatchList have average fundamentals. Should the uranium spot price continue to surge up, there is a good chance uranium stocks will continue to benefit but one needs to be aware of the risks. Check in with VectorVest each day to find the Uranium stocks with the best combination of fundamental and technical analysis.

Take out a trial to VectorVest to check out the full list of uranium stocks.

CLICK HERE TO TAKE OUT A 30 DAY TRIAL

Residents of Australia:

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment