Shares of Rivian Automotive Inc. (RIVN) surged after receiving a major boost from news that California will revive incentives for EV buyers and a settlement was reached with Tesla over a 2020 lawsuit. These positive updates are lifting investor sentiment, but does Rivian have the fundamentals to match the excitement?

Key Catalysts for Rivian

Rivian’s stock jumped 13% following two major developments. First, California Governor Gavin Newsom announced plans to revive the state’s Clean Vehicle Rebate Program (CVRP), which would provide incentives for EV buyers in the event that President-elect Donald Trump follows through with eliminating federal EV tax credits. California is the largest market for EVs in the U.S., making this a significant boost for Rivian.

Second, Rivian reached a conditional settlement with Tesla in a legal battle that accused the company of poaching employees and stealing trade secrets. Tesla has agreed to dismiss the case by December 24, which alleviates some of the legal uncertainties that have surrounded Rivian.

Additionally, Rivian announced it secured a $6.6 billion loan from the U.S. Department of Energy (DOE) to fund its new production facility in Georgia, aimed at ramping up production and bringing new models to market. This loan marks a positive step forward in Rivian’s expansion plans and production capabilities.

Challenges Remain

While these developments have fueled a strong rally in RIVN’s stock, it’s important to remember that the company is still in a highly competitive industry. Rivian faces growing competition from established automakers like Tesla and traditional car manufacturers entering the EV space. Additionally, Rivian’s path to profitability remains uncertain, and it continues to grapple with production challenges, as reflected in its wider-than-expected losses in recent earnings reports.

Analyst Sentiment and Market Outlook

Analysts are divided on Rivian’s future prospects. Some analysts have raised their price targets, with Canaccord Genuity setting a target of $23, suggesting a potential upside of over 100%. However, others remain cautious, citing concerns about Rivian’s ability to scale production and compete with bigger, more established players in the EV space.

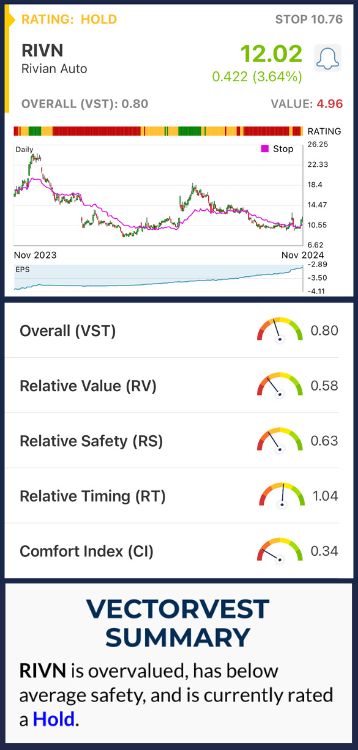

Rivian Has Poor Upside Potential, Fair Safety, and Fair Timing

VectorVest simplifies your trading strategy by taking complex technical indicators and financial data and distilling them into just 3 ratings, which give you all the insight you need to make calculated investment decisions.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy, but it actually gets even easier.

The system gives you a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. That said, here’s what we uncovered for RIVN:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers much better insight than the typical comparison of price to value alone. As for RIVN, the RV rating of 0.58 is poor.

- Poor Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.63 is poor as well for RIVN.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. Rivian’s RT rating of 1.04 reflects fair timing. While the stock has seen a boost recently, its overall market momentum is neutral, and it may not be positioned to sustain a strong upward trend in the long term.

The overall VST rating for Rivian is 0.80, which is considered below average. VectorVest recommends a Hold for Rivian at the moment, as the stock is showing some positive movement but lacks strong fundamentals to justify significant growth at this time.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. RIVN’s recent rally is a promising sign, but investors should be cautious. While the company is making strides with new government incentives, settlements, and loans, the EV market remains highly competitive, and Rivian still faces significant challenges.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment