Despite the positive reports from Morgan Stanley and Goldman Sachs, Tuesday was a damp day following Fed Christopher Waller’s comments to approach rate cuts slowly. Rate cuts are always good news, but his speech was not what hopeful investors wanted to hear. After anticipating six cuts in 2024 starting in March, the speech contradicted investors’ optimistic sentiment by suggesting slowly approaching rate cuts and emphasizing fluff in the data.

Waller’s comments caused an adverse reaction that contributed to equities falling, corresponding with the rising US dollar. The day ended with the indexes closing in the negatives, leading to a pessimistic sentiment today. Let’s explore how a Fed figure impacts the market and what exactly Waller stated.

What is the Fed?

The Fed, formally known as the Federal Reserve System (FRS), is the central bank of the United States. It was established by the Federal Reserve Act on December 23, 1913, after the panic of 1907 caused by a 50% dip in the NYSE. The incident ultimately highlighted the need for a central bank with the goal of providing the U.S. with a safe, flexible, and stable monetary and financial system.

The Federal Reserve System comprises a Board of Governors with seven members (Waller being one of them), 12 regional Federal Reserve Banks, and the Federal Open Market Committee. Each regional bank is responsible for a specific geographic area in the U.S. and collectively makes decisions on the following subjects.

- Monetary Policy: Conducting national monetary policy to ensure maximum employment, stable prices, and moderate long-term interest rates.

- Supervision and Regulation: Overseeing banking institutions to ensure the safety of the U.S. banking and financial system and protect consumer credit rights.

- Financial Stability: Maintaining stability and containing systemic risk within the financial system.

- Banking Services: Providing pivotal financial services, including operating the national payments system.

The Fed has a dual mandate of ensuring price stability and maximum employment. It is also the primary regulator of banks that are members of the Federal Reserve System and serves as a lender of last resort. When the Fed makes comments, especially Chair Powell, the market adjusts to the plans of the US central bank as they significantly impact the US economy.

If any or all of that went over your head, remember that the significant factor moving forward for the US economy is interest rates, which the Fed controls. The hope is for six interest rate cuts in 2024, but as already stated, Waller is hesitant to execute those cuts, which could mean later and fewer cuts based on his analysis. The initial conversation on rate cuts with Fed Chair Powell boosted the market significantly, but with comments from Waller, the market adjusted to the potential of waiting for rate cuts.

What did Waller say?

Fed Waller might’ve suggested slowing the rate of interest rates, which surprised investors despite being categorized as a hawk (a policymaker primarily concerned with controlling inflation with higher interest rates and tighter monetary policy). His statements are particularly significant because he is a voter on the Board of Governors, indicating his opinions will impact future policy actions.

What exactly did Waller say? A compilation of his most significant comments includes:

- I see the surprises in the December jobs report as largely noise against a trend of ongoing moderation that supports progress toward 2 percent inflation.

- I believe we are on the right track to achieve 2 percent inflation.

- Clearly, the timing of cuts and the actual number of cuts in 2024 will depend on the incoming data.

- When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully…. I see no reason to move as quickly or cut as rapidly as in the past.

This clearly indicates that rate cuts are on the way, but with a ‘methodically and carefully’ thought-out plan to get there that is data dependent. Despite the positive thread throughout the speech, investors saw that we would have to wait on rate cuts, which has carried over into the sentiment of yesterday and today.

Waller’s Comments Impact Market Sentiment

Although numbers and financial analysis are the key factors to consider when making investment decisions, market sentiment can drive the market’s success or drag it down, and comments from the Fed impact market sentiment. Market sentiment is the overall consensus among investors around the current state of the markets or given security, which is what occurred yesterday following Waller’s comment.

Market sentiment is triggered by a variety of factors, with a few listed below;

- News and Media

- Global Events

- Market Volatility

- Herd Mentality

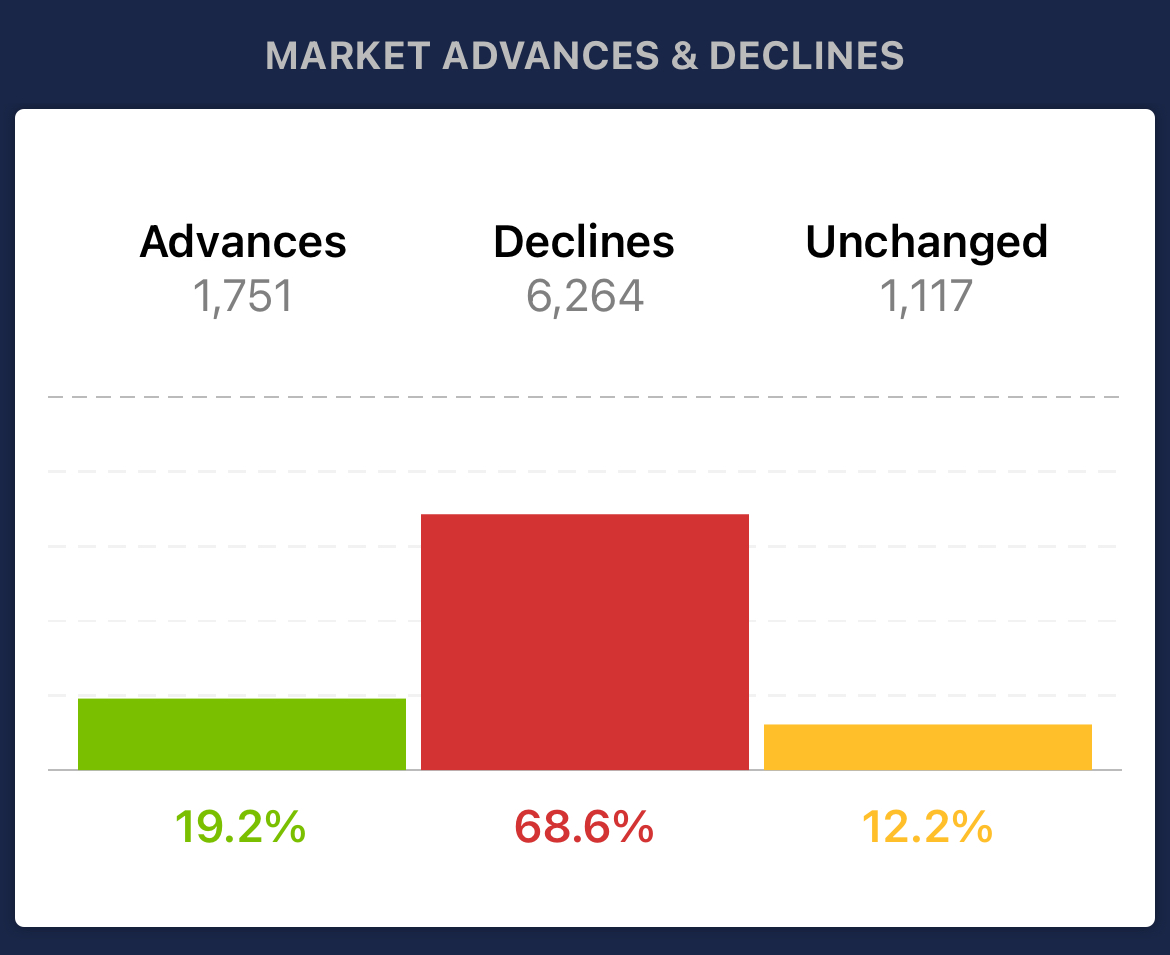

The speech provided by the Fed falls into the news and media category, contributing to negative market sentiment. As already stated, the market ended below expectations as it adjusted to the news of delayed rate cuts, with equities falling that continues today. Using VectorVest’s software, you can get a visual of the movements on the market, and there has been a dominating presence of declining equities compared to advances or those that are unchanged.

Moving Forward

Moving forward, the market’s reaction to Fed Waller’s comments suggests a period of adjustment and cautious optimism. Investors and market analysts closely monitor further communications from the Federal Reserve, especially regarding interest rate policies and economic indicators.

As the market digests this new perspective, it may experience volatility and shifts in sentiment. Investors should stay informed about Fed announcements and economic reports, as these will play a crucial role in shaping market trends in the near future. Additionally, the broader context of global economic conditions and domestic financial stability will continue to influence investment decisions. Ultimately, Waller’s cautious stance on rate cuts reminds us of the Fed’s balancing act between fostering economic growth and controlling inflation, a dynamic that will remain central to the market’s trajectory in 2024 and beyond.

If moving through those turbulent times provides uncertainty, VectorVest can completely take the guessing game away and provide concrete recommendations about what to buy and when to buy it. There’s an opportunity to make money in the markets no matter when rate cuts do or don’t happen, and you just need to utilize the right tools to make it happen. Try out VectorVest today and get a clear, definitive answer on maneuvering market sentiment and Fed comments.

Leave A Comment