Written by: Angela Akers

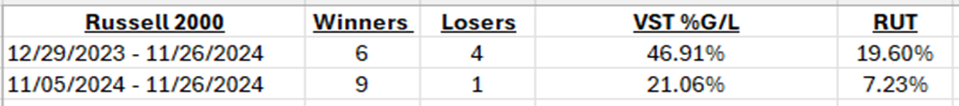

The Russell 2000 is the quintessential index of the Small Cap market and is up 19.60% year-to-date through November 26, 2024. More than 8% of that gain came during the post-election market run. I ran across an article on Financial Times Monday morning titled “Trump rally carries US small-cap stocks to all-time high.” It began, “The main index of small US stocks hit a new record on Monday for the first time in three years, as investors bet that Donald Trump’s election victory would jump-start their performance after years of lagging behind larger peers. The Russell 2000 rose more than 2 percent to a high of 2466.48, buoyed by a broad market rally as Trump’s selection of Scott Bessent as Treasury secretary eased investor concerns that the president-elect would bring in sweeping tariffs that hit economic growth.”

What is the catalyst? Well, Trump’s promises of lower corporate taxes and the expectation of further interest rate cuts in the coming year bode well for smaller companies that historically carry more debt. Therefore, the potential for Small Caps to continue their ascent seems viable.

However, with the Russell having 2000 stocks (give or take depending on the rebalancing period), how do we know which Small Caps to invest in? Honestly, it’s almost criminal how easy it is to find the winners and maybe you’re getting sick of it, but after more than 28 years, QuickTesting is still one of my favorite things to do. I think of myself as a “prove it to me” kind of person, and running QuickTests helps me target the best approach. Not surprisingly, I found that it is easy to find the winners by using the VectorVest default sort, VST.

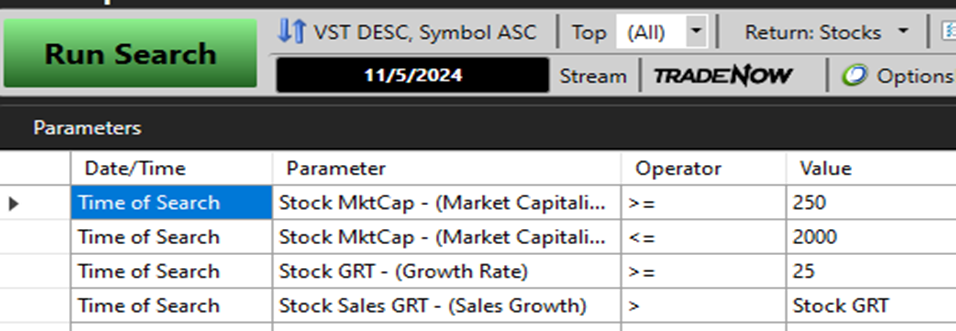

OK, not bad, my search more than doubled the performance of the Russell 2000 (RUT), but let’s talk about finding small cap stocks in general. Investopedia defines a small-cap stock as “a company with a market capitalization of between $250 million and $2 billion” and “small-cap stock investors are generally looking for up-and-coming young companies that are growing fast.”

I set out to build a search to find these stocks and that is where the VectorVest UniSearch tool comes in. The first thing I did was add the market capitalization parameters. I then added an earnings growth parameter that looks for GRT > 25% (ie, growing fast). The final parameter I added looks for companies that have Sales Growth that is higher than Earnings Growth. And since I already determined the optimal sort to use in this case was VST, that’s what I decided to use.

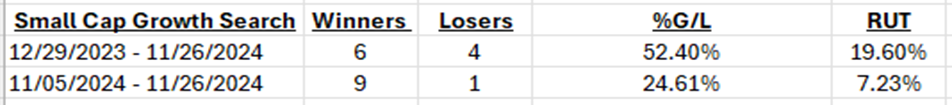

Here are the results of that search during the same periods as shown above:

You may wonder why I used the final parameter above. Well, I’ll tell you. Sales growth is vital to a company’s long-term viability and increased sales normally lead to rising earnings which, in turn, drives a company’s stock price higher and higher. Dr. DiLiddo showed me this little parameter several years ago and I’ve used it often. In my experience, it does lead to better performance overall. Even with small cap stocks.

One of my family’s Thanksgiving traditions each year is to talk about what and who we are grateful for. When thinking about what I’m thankful for, Dr. DiLiddo is always top of mind. I love him dearly and he taught me so many things in life, both personal and professional, along with the investing tutelage he so generously gave me (and the world). So, during the Thanksgiving holiday, I always think of him and smile, especially when I use one of his Secret Ingredients.

PS. Join Mr. Todd Shaffer for tonight’s “Special Presentation” for more on Small Caps!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment