THE MARKET IS ON TRACK!

By the time you read this weekly Essay, the US election will be over. Over the last week, there has been a tremendous amount of discussion regarding who will win the US Presidential election and what the impact will be on the markets globally. Markets are forward looking and, chances are, all outcomes of the US election have already been priced in.

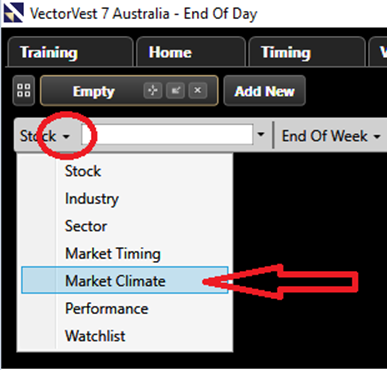

Regardless of the US election and the possible outcome, the overall market is holding up very well. You have the tools with VectorVest to check each day. No guesswork, no opinion, just the facts at your fingertips. A useful technique in VectorVest is to check in on the Market Climate Graph each week to get the macro picture of the market. To do so, click on the Graphs tab, then per the left side of your screen where it notes Stock, click on the drop-down arrow and select: Market Climate.

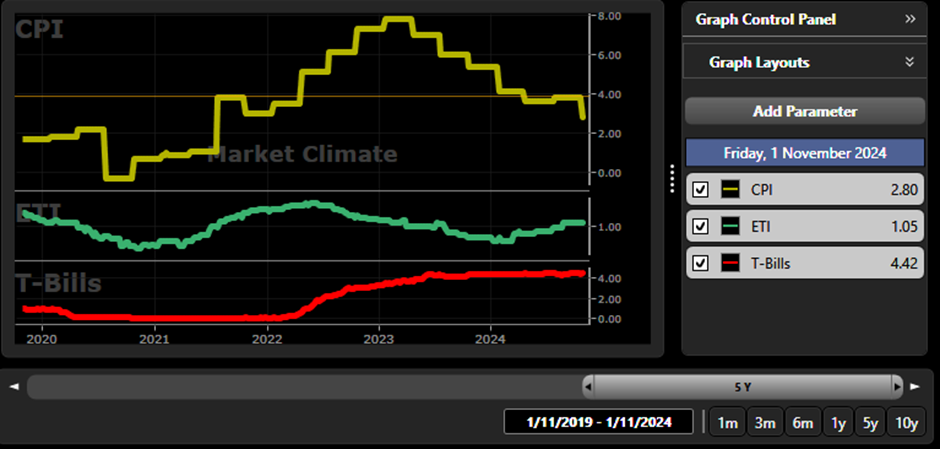

On the Market Climate Grah, put on the Consumer Price Index (CPI), the Earnings Trend Indicator (ETI) and T-Bills (click on Add Parameter per the Graph Control Panel to add in your given parameters). Once you have the given indicators on your graph, set the time frame over 5 years such that your graph looks as follows:

Notice how the T-Bills indicator (which is a good representation of interest rates) sat close to 0% from 2020 through 2022. Notice how CPI which measures inflation started to pick up significantly by the end of 2022. The ETI indicator looks at earnings health. An ETI score above 1.00 depicts healthy, rising earnings and a score below 1.00 notes earnings under pressure and falling. Note how the ETI indicator has been trending up since March 2024 on average across the Australian market.

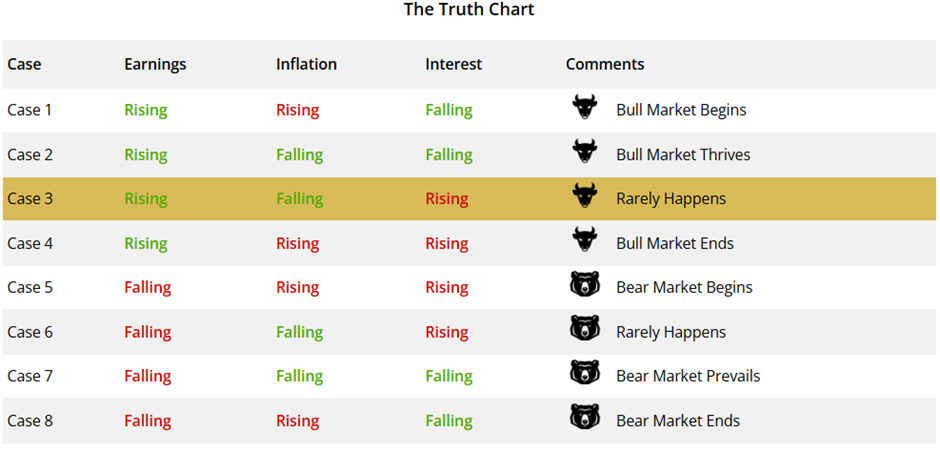

For a bull market to thrive, earnings need to be going up while interest rates and inflation are falling (Case 2 Bull Market Scenario). Per the Market Climate Graph above, we can see that Earning are rising (ETI), Inflation is falling (CPI), and interest rates are rising (T-Bills). The combination of these 3 indicators puts us in a Case 3 Bull Market scenario on the Truth Chart – a Bull Market that Rarely Happens. You can find the Truth Chart in any of the Weekly newsletters (Which can be found per the Views tab and clicking on Essays).

Note, should interest rates start falling, and if Earnings continue to rise and inflation keeps falling, we will revert into a Case 2 Bull Market scenario where the Bull Market Thrives. With the Reserve Bank of Australia likely to cut interest rates by early next year, we may very well find ourselves in a thriving bull market regardless of the US election outcome.

Residents of Australia:

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment