The RBA held rates at 4.35% in August, its sixth consecutive hold decision, signalling rate cuts are off the table for at least the next six months because underlying inflation is not tracking fast enough towards the RBA’s 2 – 3% target range. It now expects to reach the target towards the end of 2025 or possibly mid 2026 due to persistently high inflationary pressures in the economy.

The RBA said that its latest decision could result in the economy slowing more quickly, with inflation coming down more quickly than they expected and if that happened then interest rate cuts would be on the agenda.

In reaction to the RBA’s decision, experts have commented on the rate hold and what this decision means for the future of the economy. Two of the four major banks – CBA and Westpac are still holding on to a rate cut before the end of the year.

With the uncertainty and differing views surrounding the next interest rate cut by the RBA, we will turn to VectorVest for deeper insights during this time of volatility and uncertainty.

The exercise starts by looking at the direction of interest rates in the USA. Many of our Australian subscribers closely follow the Federal Reserve (FED) in the USA as a rate cut there could cast light on the timing of a future rate cut in Australia.

The recent FED announcement on 31 July 2024 has relevance:

“We believe that our policy rate is likely at its peak for this tightening cycle and that if the economy evolves broadly as expected it will likely be appropriate to begin dialling back policy constraint at some point this year. But the economy has surprised forecasters in many ways since the pandemic and ongoing progress towards our 2% inflation objective is not assured. The economic outlook is uncertain, and we remain highly attentive to inflation risks…”

Returning to VectorVest, we will use VectorVest’s Market Climate tools to view the inflation rate, firstly for the USA and then for Australia, remembering inflation drives interest rates which in turn drive company earnings and share prices.

If you take out a trial to VectorVest or have access to VectorVest, login to VectorVest US. Go to the Graphs tab and use the drop-down arrow to select the Market Climate Graph.

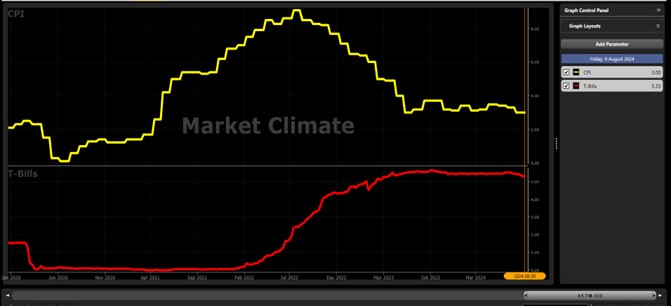

As shown in the following graph, check CPI (the inflation rate) and T-Bills (a measure of interest rates). If you need to, click on the Add Parameter tab to the right of your graph and add in these chosen indicators.

The image above is the Market Climate graph for the US Market.

Looking at a 5y graph, note how CPI has been trending down from a high point of 9.1% in July 2022, to 3% on 9 August 2024. Notice how T-Bills ramped up from a sub 0.05% rate at the end of December 2021 and now stand at 5.33% as of 9 August 2024. Higher interest rates in the USA appear to be having the desired effect on inflation giving the FED the evidence to bring in a rate cut by the end of the year.

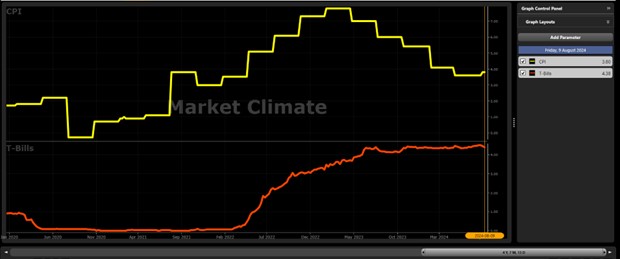

Let’s repeat the same exercise for Australia. As shown in the following graph, Australian inflation peaked at 7.8% in early 2023 (later than in the USA) and is currently at 3.8%. Notice how T-Bills ramped up from a sub 0.08% rate at the end of December 2021 and now stand at 4.38% as of 9 August 2024.

The image above is the Market Climate graph for the Australia Market

Australia started raising interest rates later than the USA and by not as much. This undoubtably has been a significant reason why inflation has proven stickier in Australia and why interest rates are some way off from being reduced as compared with the USA.

As we have demonstrated, VectorVest does have powerful tools to objectively track the trends in inflation and interest rates.

We will end our Essay with the following quote from the Governor of the RBA from last week:

“Having said that, we are data dependent, and there’s a number of things, as we mentioned in the statement of monetary policy, that could result in the economy slowing much more quickly, and inflation coming down much more quickly than we expect, and we’ll need to be alert to those.

If they come to pass, then yes, interest rate cuts would be on the agenda. But at the moment, given what we know, and the forecasts, [in] the near term, interest rate cuts are not on the agenda.”

PS Click here to see the full FED video replay.

Residents of Australia:

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment