DocuSign (DOCU) reported fiscal first-quarter earnings late Thursday that beat the consensus and marked an improvement year over year. The document signing software company also raised its forecast for the full year. And yet, shares are falling so far in Friday’s trading session.

The company’s revenue of $669.4 million represents an 11% gain year over year. This was well north of the analyst consensus of $677.5 million. Meanwhile, earnings were up 63% year over year to 72 cents per share. Analysts were looking for a mere 6 cents per share.

Looking ahead to the future, DocuSign expects to continue this trajectory and raised its full-year forecast accordingly. The company is aiming for between $2.73-$2.74 billion in sales for the year now.

Some of this growth can be attributed to a bolstered partnership with Microsoft. The tech giant will use DocuSign as part of its contract management processes.

CEO Allan Thygesen told investors that despite being satisfied with the results for the first quarter, the economic climate still presents a challenge not just for DocuSign, but all companies.

That being said, the company remains optimistic and focused on things they have control over. That includes executing strategic initiatives that improve innovation and efficiency while continuing to place the building blocks for sustainable growth in an uncertain environment.

Initially, shares had climbed more than 1.5% in Friday’s pre-market trading. But when the opening bell sounded, shares tanked nearly 5%. Why are shares down on what appears to be a positive earnings report?

It’s possible the CEO’s mention of economic challenges sparked fear in investors that caused them to ignore all the positive aspects of the earnings announcement. At this point, the stock is down more than 22% in the past 3 months.

One thing we know for sure is that if you’re a current investor or are considering trading DOCU, you’re going to want to see these 3 things we uncovered through the VectorVest stock analysis software below…

While DOCU Has Fair Upside Potential and Timing, the Safety is Poor For This Stock

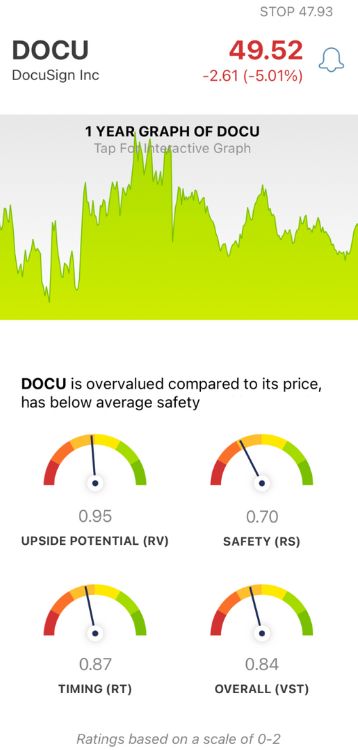

The VectorVest system simplifies your trading strategy by giving you clear, actionable insights in just 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a simple scale of 0.00-2.00 with 1.00 being the average.

This allows for effortless interpretation - just pick stocks with ratings rising above the average to win more trades with less work. Or, better yet, follow the clear buy, sell, or hold recommendation VectorVest offers for any given stock, at any given time. As for DOCU, here’s what we found…

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. This offers much better insights than a simple comparison of price to value alone. As for DOCU, the RV rating of 0.95 is slightly below the average but considered fair nonetheless.

- Poor Safety: The RS rating is an indicator of risk. It’s calculated through an analysis of the company's financial consistency & predictability, debt-to-equity ratio, and business longevity. Right now, DOCU has a poor RS rating of 0.70.

- Fair Timing: The stock has an RT rating of 0.87 - again, below the average but still considered to be fair. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.84 is considered poor for DOCU. So, does that mean it’s actually time to sell shares despite a positive earnings report? Or, should you hold on and see what happens with the stock in the coming days?

Get a clear answer on your next move so you can make it with complete confidence and clarity. A free stock analysis at VectorVest is just a click away and will offer a buy, sell, or hold recommendation!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite an earnings beat and raised forecast, shares of DOCU are down in Friday’s trading session. The stock has fair upside potential and timing, but poor safety right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment