Tupperware Brands (TUP) lost almost all of its value overnight after the company announced it would be filing for bankruptcy. The stock sat at $1.19 per share but has plummeted 57% to just $0.5 per share this morning. Exchanges like Robinhood have halted trading on the stock since.

It’s been a tumultuous stretch for the home goods brands, which is now seeking protection in the court system after it allegedly violated the terms of its debt agreements. The Florida-based company is in talks with experts to advise further on the matter.

Tupperware has been a beloved American brand for over 78 years now, but the company’s financial situation has only gotten worse as time goes on. It’s racked up over $700 million in debt and is struggling to stay afloat.

It’s important to note that plans for bankruptcy are tentative and subject to change. The company is negotiating with its lenders and looking for alternative solutions, but the future does indeed look bleak.

We first got bankruptcy warnings in April of 2023, and the brand lost 50% of its value on that occasion as well. Just a few months back Tupperware announced it would be forced to close its last standing facility here in the US starting in 2025. It also announced more than 140 employees would be laid off in an effort to shore up expenses.

The company has taken steps to turn things around, like bringing in its new CEO Laurie Ann Goldman last October, the previous CEO of Spanx. So far, though, it hasn’t turned out to make much of a difference in Tupperware’s fate.

Other legacy companies are finding themselves in similar situations amidst a challenging economic backdrop – like Red Lobster, Big Lots, and more.

At this point, the future looks sealed for TUP – we’ve taken a closer look at this situation through the VectorVest system and have 3 things you need to see if you still haven’t cut losses.

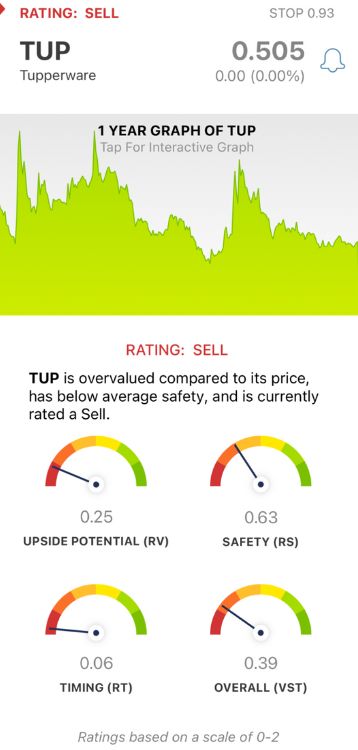

TUP Has Very Poor Upside Potential and Timing With Poor Safety

VectorVest helps save you time and stress in your approach to stock analysis while empowering you to win more trades through its proprietary system. You’re given everything you need to make calculated, emotionless investment decisions in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even easier, though. You’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for TUP, here’s what we found:

- Very Poor Upside Potential: The overall RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This makes it a much better indicator than the typical comparison of price to value alone. Even after falling to rock bottom, TUP has a very poor RV rating of 0.25.

- Poor Safety: The RS rating is a risk indicator that’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.63 is poor for TUP.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. After losing almost all remaining value, TUP has a very poor RT rating of 0.06.

The overall VST rating of 0.39 is very poor for TUP, and the stock is clearly a SELL right now. If you’re still holding onto shares, it’s time to offload them while you can.

Meanwhile, you can get a free stock analysis for any other opportunity you’ve been eyeing right here at VectorVest. Transform your strategy for the better and win more trades with less work!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. TUP announced bankruptcy today as it appears no other options are left to manage the $700 million in debt it owes. The stock has very poor upside potential and timing with poor safety, as the writing seems to be on the wall for this legacy brand.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment