Wells Fargo (WFC) disclosed its third-quarter earnings results this morning and shares are up more than 5% so far today. The company easily surpassed Wall Street expectations for the bottom line, although revenue fell just short of the consensus estimate:

- Adjusted earnings per share: $1.52 compared to the $1.28 consensus.

- Revenue: $20.37 billion compared to the $20.42 billion consensus.

Net income of $5.11 billion was a step backward from the $5.77 billion reported this time last year. The company did note that some of this was attributed to debt security losses in the amount of $447 million.

Revenue was also a slight disappointment year over year, as the bank brought in $20.86 billion in the third quarter of 2023.

One of the biggest takeaways from the third quarter performance was a decline in net interest income. This figure speaks to how much money the bank is making on its loans. It fell 11% in the quarter to just $11.69 billion. Analysts were expecting $11.9 billion.

The company says there were two challenges that caused this setback – higher costs associated with funding and customers moving their money to higher-yielding deposit products.

CEO Charles Scharf says that Wells Fargo today is in a dramatically different place than it was 5 years ago from an earnings perspective. The bank has made an effort to diversify revenue sources and eliminate or sell its lower performing investment segments.

Wells Fargo also made a point to purchase more common stock in the most recent quarter, with another $3.5 billion in repurchases. This brings the tally to $15 billion for 2024 so far, up 60% from this time last year.

WFC is now up more than 24% through the year thus far, with 14% of that coming in the past month alone. The stock is certainly trending in the right direction, but is now a good time to buy?

We’ve taken a look in the VectorVest stock analysis software and found 3 things you need to see to help make your next move with confidence and clarity.

WFC Has Good Upside Potential, Fair Safety, and Very Good Timing

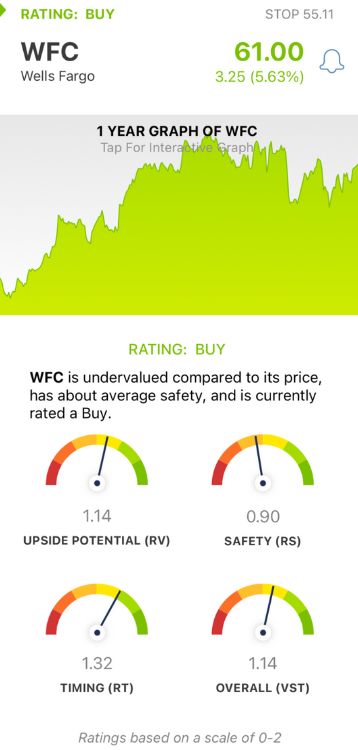

VectorVest simplifies your approach to stock analysis by delivering clear, actionable insights in just 3 ratings. This saves you time and stress while helping you win more trades. The ratings are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even better, though, as you’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for WFC:

- Good Upside Potential: The RV rating is a far superior indicator to the typical comparison of price to value alone. It compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. WFC has a good RV rating of 1.14. The stock is slightly undervalued with a current value of $67.85/share.

- Fair Safety: The RS rating is a risk indicator. It’s calculated from a deep analysis into the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.90 is a bit below the average but still deemed fair for WFC.

- Very Good Timing: The RT rating is based on the direction, dynamics, and magnitude of teh stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.32 is very good for WFC and reflects the stock’s performance through this year so far.

The overall VST rating of 1.14 is good for WFC and the stock is currently rated a BUY in the VectorVest system. But if you want to take advantage of this opportunity, take a closer look at this free stock analysis and set yourself up for a smooth, profitable trade.

See how much simpler investing can be with VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. WFC is up 5% and counting today after solid Q3 earnings results. The stock itself has good upside potential, fair safety, and very good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment