Shares of Walgreens Boots Alliance (WBA) are down 22% this week after taking a nosedive Thursday on the heels of a disappointing Q3 performance coupled with a downtrodden outlook. This is the lowest we’ve seen the stock in 27 years, and we don’t see light at the end of the tunnel.

The company’s fiscal third quarter sales grew to $36.35 billion from $35.42 billion this time last year. This narrowly outperformed the consensus of $35.94 billion.

The issue for Walgreens was the profit miss. Net income of $344 million was a huge improvement year over year from just $118 million in the previous period. However, the company’s adjusted earnings per share was only 63 cents, below the estimate of 68 cents.

The drugstore chain is doing what it can to bring costs down. It has closed (and continues to close) stores that serve as dead weight and is in the midst of making efforts to improve customer and patient experience across physical and online stores.

However, prices for drugs continue to come down as pharmacy benefit managers negotiate better prices for insurers and employers, putting pressure on margins. One of the worst offenders right now is the new class of GLP-1 drugs, including Ozempic and Mounjaro. There has also been a dip in prescriptions.

CEO Tim Wentworth spoke to these challenges holding the company back, saying that the current environment is eroding profits and that the team is doing what it can to urgently address these issues and uncover new growth opportunities.

The real issue, though, is that the company’s outlook doesn’t instill much optimism that things are going to get any better. Guidance for the full-year EPS of $2.80 to $2.95 is well below the previous forecast of $3.20 to $3.35. Analysts are expecting at least $3.20.

This is the second quarter in a row we discussed a Walgreens earning miss. Just 3 months ago the stock sat at $21/share after falling short in Q2, at which point WBA was a hold.

But today it sits at just $12.53, down 52% so far this year and trading at a low point we haven’t seen for the stock since 1997. When we last discussed WBA the stock was still a hold in the VectorVest stock software. Now, though, it’s time to sell.

WBA May Have Excellent Upside Potential, but Poor Safety and Very Poor Timing Mean It’s Time to SELL

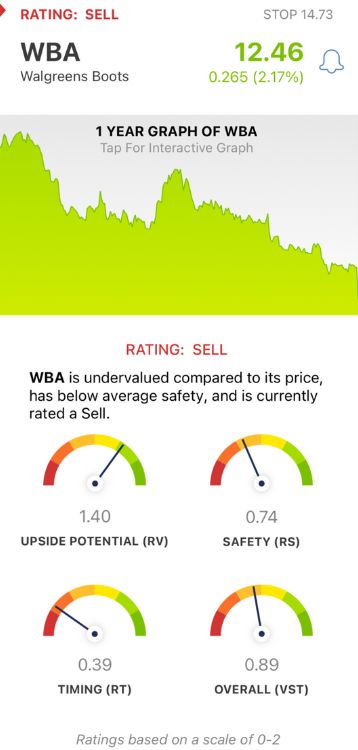

VectorVest simplifies your trading strategy through a proprietary stock rating system that gives you all the insights you need in 3 ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. You’re even given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for WBA, here’s what you need to know:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This is a much better indicator than the typical comparison of price to value alone. WBA has an excellent RV rating of 1.40, suggesting it may be undervalued at today’s much lower price.

- Poor Safety: The RS rating is a risk indicator derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. WBA has a poor RS rating of 0.74 right now.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The very poor RT rating of 0.39 reflects the stock’s performance through 2024 thus far.

The overall VST rating of 0.89 is considered fair for WBA, but the stock is still rated a SELL - it’s time to cut losses if you haven’t already.

If you’re still not convinced, get a free stock analysis here and see for yourself. Leverage the VectorVest system to remove emotion and stress from your strategy to win more trades with less work!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. WBA is down 22% this week after another disappointing earnings day coupled with weak guidance for the remainder of the year. The stock itself may have excellent upside potential, but poor safety and very poor timing earn it a SELL.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment