Shares of Ulta Beauty Inc. (ULTA) fell as much as 10% last week after a downtrodden earnings update for the second quarter. This puts it down nearly 13% through 2024 thus far.

However, the stock is now only down 3% in the past week after recovering since Thursday. Shares are up more than 2% so far after the long weekend.

Many are calling this a buying opportunity as the stock now sits at a great value. Even Warren Buffet’s Berkshire Hathaway loaded up on ULTA earlier this month, picking up 690,000 shares.

Competitive dynamics have been evolving around the beauty space, and while Ulta was once the top player, companies like Sephora have started to steal market share. Even Walmart is getting ready to roll out its own premium beauty marketplace.

Many analysts are still bullish on Ulta, though, despite its first earnings miss since May 2020. The company posted earnings per share of $5.30 compared to the consensus estimate of $5.46 and revenue of $2.55 billion compared to the consensus estimate of $2.61 billion.

CEO Dave Kimbell said the company is not satisfied with its performance in the quarter and management is on the same page as to what led to these disappointing results. Kimbell says measures to turn things around are already in place.

Looking ahead to the remainder of the year, same-store sales growth is now anticipated to be flat up to 2%. The previous guidance called for 2% growth at the low end, with as much as 3% at the high end.

If you’re a current investor or looking for a buying opportunity to get into this stock, where does all this leave you? We’ve taken a look at ULTA through the VectorVest stock software and uncovered three things you need to see before you do anything else.

ULTA Has Very Good Upside Potential With Fair Safety and Timing

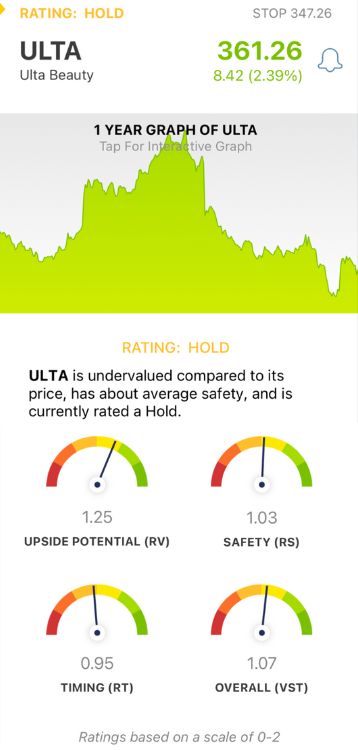

VectorVest saves you time and stress while empowering you to win more trades with less work. It’s a proprietary stock rating system that distills complex technical and fundamental data into 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These each sit on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even better, though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s the situation for ULTA:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. ULTA has a very good RV rating of 1.25. After the recent sell-off, the stock is undervalued, with a current value as high as $506.24.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. ULTA has a fair RS rating of 1.03.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.95 is fair for ULTA.

The overall VST rating of 1.07 is also fair, but it’s not enough to earn the stock a buy recommendation just yet. ULTA is still rated a HOLD in the VectorVest system.

There’s more to this story that we haven’t shown you yet, though. For more insights to help you make your next move with ULTA, get a free stock analysis at VectorVest today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ULTA has started its recovery after losing 10% last week, but the stock is still down nearly 13% through 2024. Despite weak earnings, there are reasons to be bullish on ULTA. It’s still not time to buy though, as the stock has just fair timing and safety despite very good upside potential.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment