Late last week Stellantist (STLA) announced its plans to change things up from a management perspective. After a few consecutive periods of bleeding profits and lowering production, it was time to breathe fresh life into the company.

Now, the company’s current CEO of Jeep – Antonio Filosa – will step in as COO of the group’s entire operations across North America. Doug Ostermann will take the helm as CFO, replacing previous executive Natalie Knight.

There are also changes made in Europe and China along with a new CEO appointment for the company’s Maserati and Alfa Romeo brands. Stellantis is still on the hunt for a replacement CEO for Carlos Tavares, who will be retiring at the start of 2026 as soon as his contract expires.

Tavares is not going quietly into the night, though. He’s clearly making a point to leave the company in a good state. He spoke to the currently tumultuous state of the automotive industry, referencing it as a “Darwinian period.”

“Our duty and ethical responsibility is to adapt and prepare ourselves for the future, better and faster than our competitors to deliver clean, safe and affordable mobility.” – Carlos Tavares

STLA initially fell 4% on the news Friday when it was announced, but after the weekend they’ve begun recovering. They’re up more than 1% so far today Monday morning.

This update comes on the heels of a brutal start to the month, in which Stellantis announced cuts to its previous forecast for profit, free cash flow, and sales. The stock tumbled more than 11% on the news.

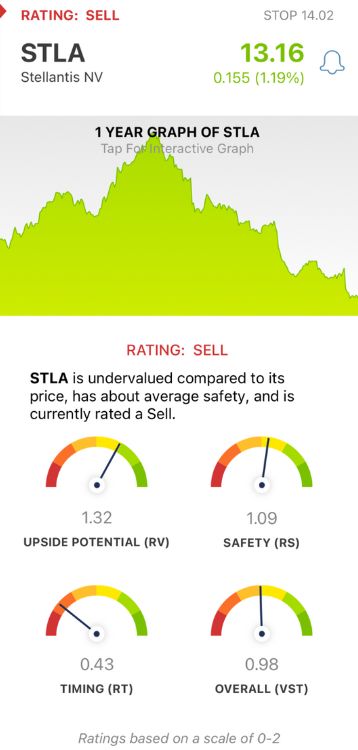

That was two weeks ago, and STLA was rated a SELL in the VectorVest system. Is that still the case today? We’ve taken another look at this stock and found 3 things you need to know whether you’re a current investor or are looking for an opportunity to trade STLA.

STLA Still Has Very Good Upside Potential With Fair Safety and Very Poor Timing

VectorVest is a proprietary stock rating system designed to save you time and stress while empowering you to win more trades with less work. It does this by delivering clear, actionable insights in just 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

It gets even better, though. You’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for STLA, here’s what we uncovered:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. The RV rating of 1.32 is still very good for STLA, and the stock is still undervalued with a current value of $17.56/share.

- Fair Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. While STLA had a good RS rating a few weeks ago, it has slipped since. Now, the RS rating of 1.09 is just fair.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating has only gotten worse for STLA, as it now sits at just 0.43 - which is very poor.

The overall VST rating of 0.98 is just below the average but deemed fair nonetheless. Still, STLA remains a SELL in the VectorVest system as it continues to slide lower and lower.

If you want to learn more about this situation or any other opportunity, get a free stock analysis at VectorVest today. It’s time to transform your trading strategy for the better.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. STLA continues to fall lower and lower, this time after announcing a dramatic management shakeup of the group itself and many of its individual auto manufacturers. The stock itself still has very good upside potential despite very poor timing - but, safety is just fair now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment