Salesforce.com (CRM) is at risk of taking on its biggest single-day loss since August of 2008 today. The company’s Q1 earnings sent shares down more than 20% Thursday morning as the software industry continues to get battered and bruised.

Fiscal first-quarter revenue came in at $9.13 billion, which was slightly below the FactSet consensus of $9.15 billion but still an 11% growth year over year.

Meanwhile, net income of $1.53 billion was a solid improvement year over year compared to just $199 million last year. On an adjusted basis, the company earned $2.44 per share compared to the consensus of $2.37 per share.

The real concern is in regard to the current quarter outlook, though. Salesforce is expecting revenue between $9.20 billion to $9.25 billion and adjusted earnings between $2.34 to $2.36. This is setting up for a disappointment in comparison to the analyst consensus of $9.35 billion in revenue and $2.40 per share.

COO Brian Millham says that the company continues to face challenges in its sales cycle, including longer deal cycles and more scrutiny over budget. The company is also narrowing its focus on long-term productivity and customer experiences, which will impact sales in the short term.

Now, there were a few positive takeaways from the earnings call. The company’s data-cloud growth climbed 25% while the Mulesoft segment saw growth of 27%.

However, Salesforce walked back its full-year outlook for subscription and support revenue to slightly below 10% growth, whereas the previous view called for slightly above 10% growth.

If today’s performance holds, CRM will have dropped 30% in the past 3 months. That being said, should you part ways with this stock as a current shareholder? After taking a look at the VectorVest stock market software, we think so. Here’s why…

CRM May Have Excellent Upside Potential and Safety, But Very Poor Timing is Holding it Back

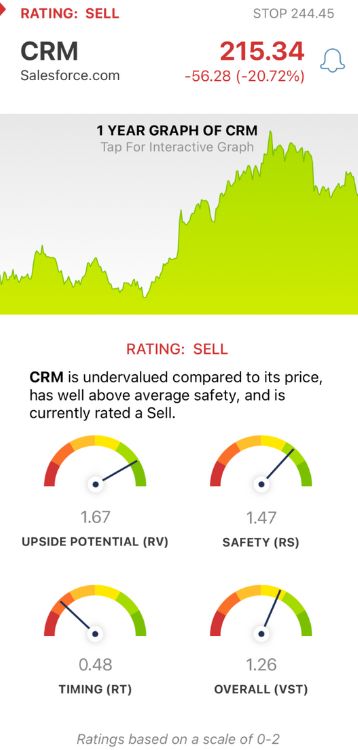

VectorVest is a proprietary stock rating system designed to save you time and stress while empowering you to win more trades. You’re given all the insights you need to make calculated, emotionless decisions in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes analysis quick and easy, but it gets even easier - you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for CRM:

- Excellent Upside Potential: The RV rating is a far superior indicator than the typical comparison of price to value alone as it compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. As for CRM, the RV rating of 1.67 is excellent.

- Excellent Safety: The RS rating is a risk indicator that’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. CRM has an excellent RS rating of 1.47.

- Very Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 0.48 is very poor for CRM.

So, does excellent upside potential and safety outweigh very poor timing, or vice versa? The overall VST rating of 1.26 is very good for CRM, but the stock is still rated a SELL in the VectorVest system.

If you’re currently holding this stock, take a moment to dig deeper with a free stock analysis at VectorVest and protect yourself from unnecessary losses. Transform your trading strategy for the better today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. CRM delivered a decent performance in the first quarter, but the company’s cautious outlook for the current quarter and the full year has sent the stock price 20% lower Thursday. The stock itself has excellent upside potential and safety, but very poor timing is holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment