Rivian (RIVN) was once the company behind one of the stock market’s largest IPOs in history. Since debuting at nearly $130/share, it’s fallen from grace to as low as $12/share. But today, RIVN stock is climbing on speculation that it’s all finally coming together for the electric automaker.

Last week, the company saw a 19% gain on news that Wedbush raised its price target by 25% to $30/share. Right now, the stock sits at $25/share. What does analyst Dan Ives see in the stock that prompted this, though?

In the second quarter, Rivian produced 13,992 vehicles and delivered 12,640 vehicles. This surpassed the estimate of just 11,000 deliveries. And, this means the company is scheduled to meet its guidance for 2023 production.

Seeing as the supply chain was one of the biggest roadblocks for this stock, this is a positive sign that the floodgates could open. Issues with production and supply have held the company back since its debut in 2021, leaving many wondering if there was any hope for Rivian.

But, the narrative shifted back when the company partnered with Amazon to deliver 100k electric delivery vans before 2030. And, this deal is finally coming to fruition – as the first batch of vans are out on the streets today here in the US and abroad in Munich, Berlin, and beyond.

That being said, is it fair to assume that Rivian has officially turned the page and is ready to surge back toward its November 2021 high point? Or, is this trend we’ve witnessed over the past week another disappointment waiting to happen? Below, we’ve assessed RIVN using the VectorVest stock analyzer. Keep reading to find out if it’s time to buy or not…

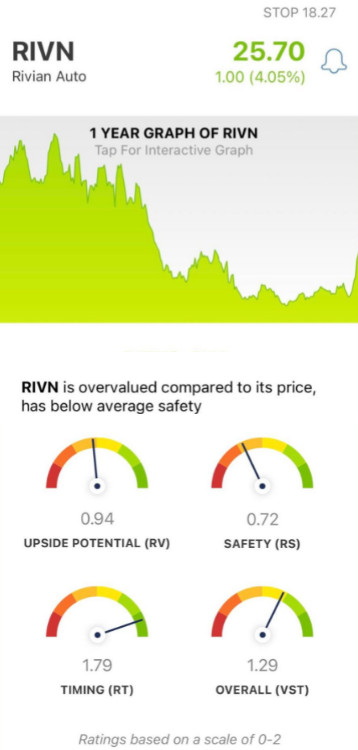

While RIVN Has Poor Safety, the Stock Has Fair Upside Potential and Excellent Timing

The VectorVest system uses a proprietary stock rating algorithm to help you uncover winning opportunities on autopilot and time your entry/exit to perfection. No more guesswork, no more human error, and no more emotional investing.

You’re given all the insights you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on a simple scale of 0.00-2.00, with 1.00 being the average. This makes interpretation quick and easy.

But, it gets even better - because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation, at any given time. As for RIVN, here’s what we see:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (projected 3 years out) to AAA corporate bond rates and risk. And right now, RIVN has a fair RV rating of 0.94, which is considered fair - albeit below the average. It’s worth noting, though, that the stock is overvalued as it stands today. Its current value is just $15.57.

- Poor Safety: In terms of risk, RIVN has poor safety - with an RS rating of 0.72. This is calculated through an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Excellent Timing: The one thing this stock has going for it is the strong positive price trend we’ve seen from over the past week. As such, the timing is excellent with an RT rating of 1.79. This is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.29 is considered very good for RIVN - is it enough to justify adding this stock to your portfolio or bolstering your existing position? Or, is this a good time to exit with your profits?

Whether you’re already invested in this stock or looking to make a move with RIVN, a clear buy, sell, or hold recommendation awaits you at VectorVest. Get a free stock analysis today and make your next move with confidence!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. As far as RIVN is concerned, the stock has poor safety, but fair upside potential and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment