Planet Fitness (PLNT) delivered third-quarter earnings that sent shares 12% higher in Tuesday morning’s session after beating the consensus on the top and bottom lines.

Revenue for the third quarter climbed to $277.6 million, representing nearly 14% growth YoY. The FactSet consensus was just $268.2 million.

A big chunk of this growth can be attributed to franchise segment revenue, which was up nearly 22% for the quarter. Meanwhile, corporate-owned stores pulled their weight as well, up almost 12%. Equipment revenue also showed a 6.1% improvement.

Profitability got a nice boost for the quarter as well. Net income of $39.1 million was much higher than the $26.9 million reported this time last year. 59 cents/share on an adjusted basis beat the FactSet consensus of 55 cents per share.

While this performance was enough to send positive ripples throughout the market, CFO Tom Fitzgerald says that the company’s growth is still being stifled by delays in opening new stores as a result of permitting problems. Planet Fitness was initially projecting to open 150-160 stores this year but now believes that figure will fall between 130-140.

Interim CEO Craig Benson also teased the possibility of raising prices on the classic $10/month membership for the first time in 30 years. As inflationary pressure continues to mount, Benson believes that there are opportunities to raise pricing without sacrificing member growth.

Looking forward to the remainder of the year, Planet Fitness expects revenue growth of around 14% now – up from the previously issued guidance of 12%. Adjusted EPS got a marginal lift as well, up to 35% from 34%.

If today’s performance holds it will be the biggest day of growth in 3 years for PLNT. The stock is now up more than 30% in the past month. So, is it time to buy PLNT?

We’ve taken a look through the VectorVest stock forecasting software and uncovered 3 things you need to see before doing anything else. Get a clear recommendation on your next move below!

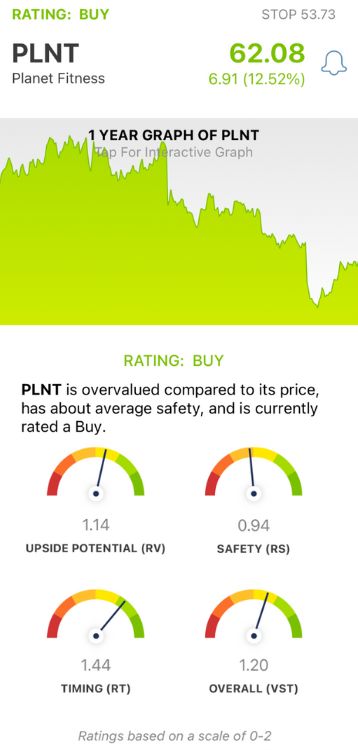

PLNT Has Good Upside Potential, Fair Safety, and Excellent Timing

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - eliminating stress, human error, and guesswork from your investment strategy. It’s all based on three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average, allowing you to quickly and easily gain insights to inform your trading strategy. But, you’re even given a clear buy, sell, or hold recommendation for any given stock at any given time! Here’s the current case for PLNT:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk, offering far better insights than a simple comparison of price to value alone. The RV rating of 1.14 is good, but the stock is overvalued right now. Current value is just $53.40.

- Fair Safety: The RS rating is an indicator of risk. It’s derived through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. PLNT is a fairly safe stock with an rs rating just below the average at 0.94.

- Excellent Timing: PLNT has been climbing higher and higher, and the excellent RT rating of 1.44 reflects that performance. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 1.20 is good for PLNT and enough to earn a BUY recommendation. Learn more about the current situation for this stock before you make your decision through a free stock analysis at VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PLNT gained 12% Tuesday after delivering a third-quarter earnings beat on both the top and bottom lines. The stock has good upside potential, fair safety, and excellent timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

DISCLAIMER: VectorVest is licensed by VectorVest, Inc., and is protected by United States copyright laws and international treaty provisions. At VectorVest, we are dedicated to providing valuable insights and information to assist you in your investment decisions. However, it's vital to acknowledge the inherent risks associated with stock investments and trading in the financial markets. You should be aware of the risks involved in stock investing, and use the material contained herein at your own risk. This material is believed to be reliable, but neither VectorVest, Inc., nor any of its suppliers guarantee its accuracy, completeness or validity, nor are they responsible for any errors or omissions which may have occurred. The analysis, ratings, and/or recommendations made by VectorVest, and/or any of its suppliers do not provide, imply, or otherwise constitute a guarantee of performance. Therefore, it should not be assumed that future results will be profitable or will equal past performance, real, indicated or implied. VectorVest and/or its principals may purchase or sell any of the securities cited herein. VectorVest and the logostyle geometric design are, individually and collectively, service marks owned by VectorVest, Inc. VectorVest is published daily by VectorVest, Inc. 2650 W. Market St., Akron OH 44333 +1 888-658-7638.

Leave A Comment