There’s no question that cybersecurity is becoming a growing concern for businesses of all sizes, which positions companies like Palo Alto Networks (PANW) to succeed.

The company’s CEO, Nikesh Arora, spoke to the need for solutions like those of Palo Alto Networks. These days hackers can do their damage in a mere 3 hours. What used to take days, if not weeks, can be done in a fraction of the timeframe, extracting terabytes of precious data.

Research has estimated that cybercrime will cost the world up to $9.5 trillion this year alone – and that figure could climb as high as $10.5 trillion next year. Most of these costs are attributed to data destruction, productivity problems, theft of IP, harm to a company’s reputation, legal costs, and potential fines.

Knowing this is the top global risk right now for most businesses, all eyes are on Palo Alto Networks leading into today’s earnings call.

Looking back at the last quarter in May, the company performed well on both the top and bottom lines. Earnings per share of $1.32 were well above the consensus and up 20% year over year, while revenue of $2 billion narrowly outpaced the consensus but showed 15% growth year over year.

The general consensus is that experts are looking for earnings at $1.41 per share, which would be up from the third quarter but down year over year slightly. The revenue consensus is pegged at $2.16 billion, which would be a slight improvement.

The opinion on Wall Street is fairly mixed regarding this stock right now. 70% of the 53 analysts polled have it a buy, while the remaining 30% are sitting on the sidelines for the time being.

It was a tough start to 2024, with the company having to rethink its full-year revenue forecast back in February. The stock lost a quarter of its market capitalization in a single day amidst this massive sell-off.

But, PANW has recovered well since then. It has gained 16% and counting so far this year and is up 2% today so far heading into the earnings update. So, where does that leave you? Should you buy this stock today?

We’ve taken a look through the VectorVest stock software and found 3 things you need to consider before you do anything else.

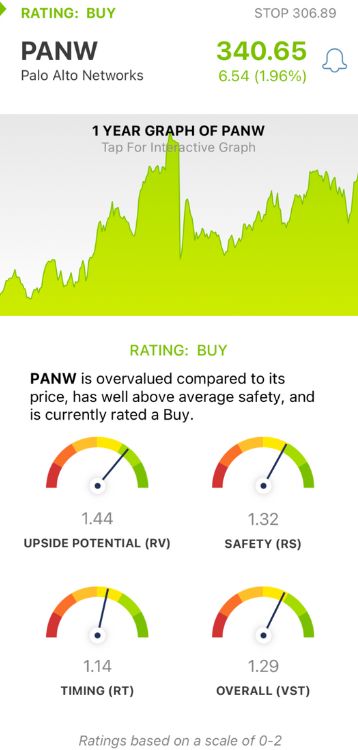

PANW Has Excellent Upside Potential, Very Good Safety, and Good Timing

VectorVest is a proprietary stock rating system that takes complex technical/fundamental data and transforms it into clear, actionable insights. You’re given all the information you need to make calculated, emotionless investment decisions in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

Better yet, you’re given a buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for PANW:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator to the typical comparison of price to value alone. The RV rating of 1.44 is excellent for PANW.

- Very Good Safety: The RS rating is a risk indicator. It’s calculated from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. PANW has a very good RS rating of 1.32.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.14 is good for PANW.

The overall VST rating of 1.29 is very good for PANW, and the stock is currently rated a BUY. But before you make that next move, take a quick look at this free stock analysis for even deeper insights. Trust us, you’re not going to want to miss this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PANW is set to declare 4th quarter earnings today, and the sentiment surrounding this stock is fairly positive. It has excellent upside potential, very good safety, and good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment