Shares of Nvidia (NVDA) have been climbing higher as the company gears up for its highly anticipated earnings report this week. Despite a slight dip in recent weeks, Nvidia’s stock has remained a favorite among investors due to its dominant position in the AI and chip industries.

The stock has had its fair share of volatility, with investors eyeing key indicators and trends in the market to determine if Nvidia will continue its bullish momentum. Heading into earnings, analysts have been closely monitoring Nvidia’s performance, as the company has been at the center of the ongoing AI revolution. The results from this report are expected to shed light on Nvidia’s growth prospects, especially with the anticipated rollout of its next-generation Blackwell AI chips.

Despite some market fluctuations, Nvidia’s fundamentals remain strong. The company’s growing role in the AI market and its strategic partnerships, including its ongoing relationship with Tesla, continue to fuel optimism. That said, investors are still wondering: Is it time to buy Nvidia ahead of its Q2 earnings, or will the stock see a correction?

We’ve examined the stock using the VectorVest stock software and found 3 reasons why Nvidia could still be a buy.

Nvidia Still Shows Excellent Upside Potential and Safety with Good Timing

VectorVest simplifies your trading strategy by telling you what to buy, when to buy it, and when to sell it, saving you time and stress while helping you win more trades with less work.

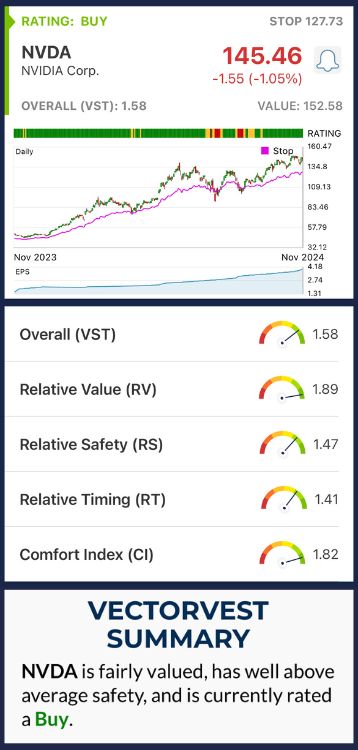

You’re given all the insights you need through 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy.

It gets even easier though. The system gives you a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s the current outlook for NVDA:

- Excellent Upside Potential: Nvidia holds an RV rating of 1.89, indicating strong long-term price appreciation potential. This rating suggests that the stock is still poised for growth over the next few years.

- Excellent Safety: Nvidia’s RS rating of 1.47 reflects the company’s strong financial consistency, low volatility, and low risk, making it a safe option for investors.

- Good Timing: The RT rating of 1.41 shows that Nvidia’s price movement is trending positively, although there’s room for improvement in the short term.

The overall VST rating of 1.58 is excellent, confirming NVDA as a BUY according to the VectorVest system. Despite recent fluctuations, the stock’s excellent fundamentals, coupled with strong upside potential, make it a solid choice for investors looking to capitalize on the AI boom.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. Despite a slight dip in NVDA ’s stock recently, the company remains strong, with the stock poised for recovery. Nvidia’s excellent upside potential, strong safety profile, and solid timing make it an attractive option for investors, even as it navigates short-term fluctuations.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment