Shares of Nvidia Corp. (NVDA) are up slightly in Wednesday morning trading as Elon Musk spoke to Tesla about relying on the company’s chips for its electric vehicles.

Musk plans on ordering between $3 billion to $4 billion worth of chips throughout this year for Tesla, which will make up nearly two-thirds of the automaker’s training infrastructure. Musk also mentioned the possibility of using the chips for his social media company, X (formerly Twitter), and xAI, an AI startup company.

This comes on the heels of CEO Jensen Haung’s announcement for a new product next year known as the Blackwell Ultra chip, along with a next-generation Rubin platform in 2026.

It’s worth noting that while Nvidia has been the Wall Street darling over the past year or two, there are others looking to steal some of the market share by offering similar products. Beyond the household names like AMD and Intel, there is a new company coming out of Taiwan known as Kneron.

It just launched its KNEO 330 product which works slightly differently than the energy-intensive Nvidia chips. By installing the chip at the customers’ physical premises it can operate at lower power without compromising on performance.

However, there is simply no slowing down NVDA – which is set to complete its 10-for-1 stock split later this week. We discussed this stock 2-3 weeks ago just before the company’s earnings, which sent shares surging from around $970 to now right around $1,164.

NVDA is up nearly 30% in the past month, and a whopping 140% through 2024 thus far. Today’s news has sent shares another 1.6% higher.

That being said, is there still room to buy this stock? We’ve taken a quick look through the VectorVest stock software and see 3 reasons to consider buying more NVDA…

NVDA Still Has Excellent Upside Potential, Safety, and Timing

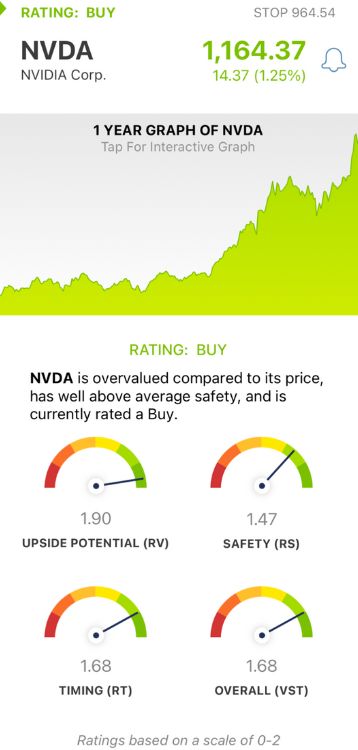

VectorVest is an intuitive stock rating system that simplifies your trading strategy by taking complex technical data and boiling it down into clear, actionable insights. In fact, you’re given everything you need to know to make confident decisions in 3 simple ratings.

These are relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a simple scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

Better yet, you’re given a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for NVDA, here’s the updated look:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This offers far superior insights than the standard comparison of price to value alone. NVDA has an excellent RV rating of 1.90.

- Excellent Safety: The RS rating is a risk indicator derived from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. NVDA has an excellent RS rating of 1.47.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.68 is also excellent for NVDA, reflecting the stock’s performance over the past year or so.

The overall VST rating of 1.68 is excellent, and enough to justify a BUY recommendation for NVDA. But before you do anything else, take a moment to review this free stock analysis for deeper insights, including where to set your stop loss. Don’t miss this opportunity to transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. NVDA has continued its rally out of Q1 earnings, gaining more than $200/share in the past few weeks. The stock is now up 140% through the first 6 months of the year, bolstered by Elon Musk’s massive order and bullish stance on the company. The stock itself still has excellent upside potential, safety, and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment