Shares of MicroStrategy Inc. (MSTR) have been on a wild ride, experiencing volatility as it continues to be a major player in the cryptocurrency market. The company recently made headlines with its $5.4 billion purchase of 55,000 Bitcoins, bringing its total holdings to approximately 386,700 BTC, valued at roughly $37 billion at current prices.

The surge in Bitcoin’s value, spurred by a favorable regulatory outlook under President Trump’s re-election, has generated heightened optimism around MicroStrategy’s stock. The company’s strategic focus on acquiring Bitcoin rather than relying solely on its software business has led analysts to raise their price targets significantly. Canaccord Genuity has lifted its target to $510, while Bernstein has increased its target to $600. Additionally, Benchmark raised its price target to $640, emphasizing MicroStrategy’s potential growth linked to its expanding cryptocurrency holdings.

However, not all news has been positive for MicroStrategy. The company’s stock took a hit recently, dropping by nearly 9% in pre-market trading before recovering slightly. Short-sellers have also expressed concerns, with Citron Research warning that MicroStrategy’s stock may be overvalued despite the ongoing Bitcoin bull market. Despite the pullback, the stock is still up more than 500% year-to-date, driven by the Bitcoin rally and the company’s continued strategy of accumulating more Bitcoin.

The company’s aggressive Bitcoin acquisition strategy has led it to be viewed as a proxy for Bitcoin, with analysts increasingly bullish on the stock due to the cryptocurrency’s continued rise. With Bitcoin nearing the $100,000 mark, investors are left wondering if MicroStrategy’s stock can maintain its upward momentum or if a correction is on the horizon.

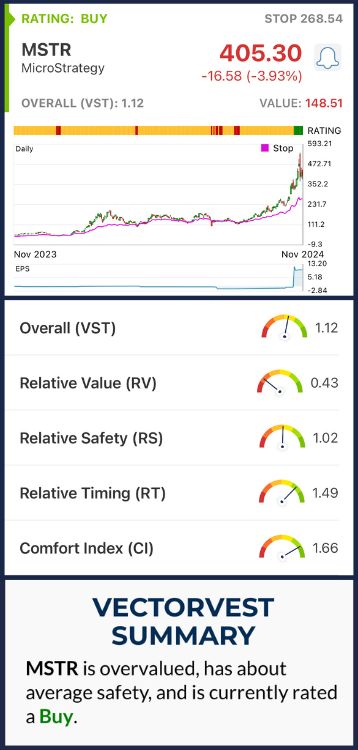

Based on the VectorVest stock rating system, here’s how MicroStrategy is performing:

MSTR Has Poor Upside Potential, Fair Safety, and Excellent Timing

The VectorVest system simplifies your trading strategy, replacing complex technical indicators and time-consuming analysis with 3 proprietary ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average. Based on the overall VST rating for a given stock you’re given a clear buy, sell, or hold recommendation - eliminating all guesswork and emotion from your decision-making. As for MSTR, here’s what we found:

- Poor Upside Potential (RV): The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. MSTR has a poor RV rating of 0.43, which indicates poor long-term price appreciation potential.

- Fair Safety (RS): The RS rating is a risk indicator derived from an analysis of a company’s financial consistency, debt-to-equity ratio, business longevity, and other factors. The RS rating for MicroStrategy is 1.02, reflecting fair safety.

- Excellent Timing (RT): The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating for MicroStrategy is 1.49, indicating excellent timing. This suggests that the stock is performing well in the current market conditions, with a strong upward momentum, particularly as Bitcoin's value continues to rise.

The overall VST rating for MicroStrategy is 1.12, which is classified as good. With a Buy recommendation from VectorVest, it's important to assess this free stock analysis and get the full picture on MSTR's potential before making any moves!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. MSTR stock has experienced substantial growth this year, largely driven by its Bitcoin holdings. Analysts remain bullish on the company due to the cryptocurrency market's bullish trajectory. However, with concerns from short-sellers and the volatility of Bitcoin, investors should exercise caution.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment