The Facebook parent company, Meta Platforms (META), is losing ground Thursday morning on the heels of a third-quarter earnings update Wednesday after hours.

While the stock is down 3% so far today, the Q3 performance was actually fairly solid. Revenue of $40.6 billion was slightly ahead of the analyst consensus for $40.2 billion. Earnings of $6.03 easily surpassed the estimate of $5.22.

CEO Mark Zuckerberg said he’s happy with the results, much of which was fueled by AI progress in apps and business models across the business. He referenced Meta AI, Llama, and AI-powered glasses all showing an upward trajectory.

Zuckerberg also teased that the company has five years of product innovation in the pipeline given the current AI technology it’s working with.

Much of the company’s revenue is advertising-driven, and experts are seeing a healthy landscape for continued performance based on surveys from ad agencies and other marketing platforms.

In fact, 43% of advertisers are planning on raising ad budgets by more than 10% in Q4 heading into the most important season of the year. AI will play a role in helping these companies put more personalized ads in front of their ideal customers with less work.

On that note, Meta is forecasting revenue in the range of $45 billion to $48 billion. Analysts are anticipating $46.2 billion. Everything looks upbeat – so why are shares down today? Some see the company’s accelerated spending plans as a concern.

Capital expenditures will come in higher for 2024 than originally expected – somewhere between $38 billion to $40 billion. The previous guidance called for $37 billion to $40 billion. Spending will rise heading into 2025, as well.

Whether this turns out to be an actual problem or not remains to be seen. In the meantime, META is still up 21% over the past 3 months and 62% in the past year.

We wrote about Meta’s Q2 results back in August, and informed our readers that the stock was a buy when it sat at just $503/share. Today it sits at $571/share. So, where does that leave current investors or those interested in trading this stock?

We’ve dug deeper into the VectorVest stock software and see 3 reasons META is still a buy.

META Has Excellent Upside Potential and Safety With Fair Timing

VectorVest is a proprietary stock rating system that simplifies your trading strategy so you can win more trades with less work and stress.

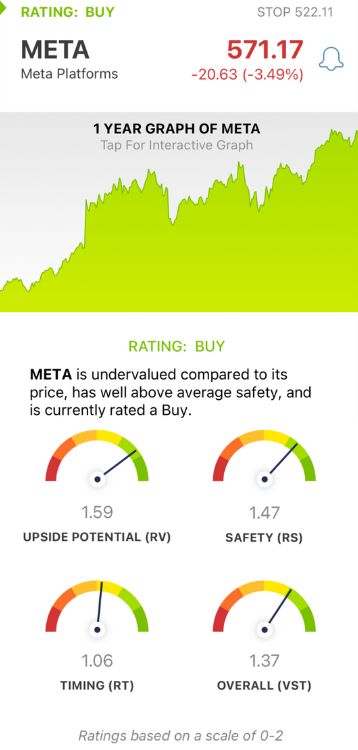

It distills complex technical and fundamental data into 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each of these sits on an intuitive scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy.

It gets even better, though. You’re offered a buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. As for META, here’s what we found:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. META has an excellent RV rating of 1.59. The stock is still undervalued, with a current value of $720.67.

- Excellent Safety: The RS rating is a risk indicator. It’s computed from a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. META has an excellent RS rating of 1.47.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. META has a fair RT rating of 1.06 despite the slip-up today.

The overall VST rating of 1.37 is very good for META, and the stock is still rated a buy today. If you’re interested in trading META take a closer look at this free stock analysis and set yourself up for a smooth, profitable trade!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. META reported impressive Q3 results yesterday alongside upbeat guidance for the current quarter. While some are concerned about the company’s aggressive spending, the stock itself has excellent upside potential and safety with fair timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment