Levi Strauss & Co. (LEVI) is up around 15% on the day so far after delivering a solid quarterly performance coupled with an optimistic outlook for the remainder of the year. The jeans maker saw a jump in sales as it narrowed focus on its direct-to-consumer segment.

The company’s fiscal first quarter saw revenue of $1.56 billion, which fell short of last year’s performance by 8%. Nevertheless, it was enough to narrowly beat the $1.55 billion analysts were expecting. Meanwhile, adjusted earnings came in at 26 cents per share compared to the consensus of 21 cents per share.

Much of this performance can be attributed to improvements in DTC through website and physical store sales, which grew 7% in the quarter. This segment made up 48% of the company’s revenue for the quarter, picking up the slack as the wholesale segment sank 18%.

CEO Michelle Gass says the focus for the road ahead is to lean into the DTC segment and become the #1 apparel retailer in its class. This will lead to better profitability, with a goal of attributing at least 55% of all sales to DTC.

Speaking of profitability, the company is trimming fat along its workforce by 10-15%, aiming to cut up to $100 million in costs before the end of 2024.

Looking ahead to the remainder of the year, Levi expects its full-year sales growth to still fall between 1%-3%. But, profits will continue to rise as the DTC business ramps up, and the company boosted its adjusted earnings range to $1.17 to $1.27 per share. The previous guidance called for just $1.15 to $1.25 per share, while analysts are expecting at least $1.21 per share.

LEVI is now up more than 38% in the past 3 months when accounting for today’s gain. So, is now a good time to buy this stock? We’ve taken a look through the VectorVest stock analyzer and found 3 things we want to share that will help you make a clear, calculated decision.

LEVI May Have Poor Upside Potential and Safety, But Excellent Timing Earns This Stock a BUY

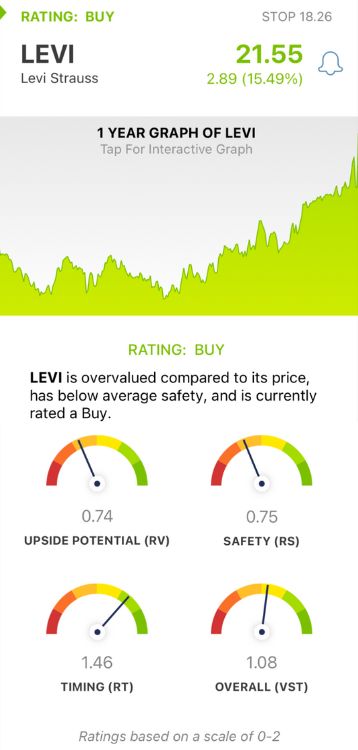

VectorVest saves you time and stress while empowering you to win more trades. It does this by delivering all the insights you need to make emotionless investment decisions in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy - but it gets even better. The system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what you need to know about LEVI:

- Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It offers far superior insights than the typical comparison of price to value alone. LEVI has a poor RV rating of 0.74 right now.

- Poor Safety: The RS rating is a risk indicator. It’s calculated through a deep analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.75 is also poor for LEVI.

- Excellent Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year to paint the full picture for investors. This is where things get interesting, as LEVI has an excellent RT rating of 1.46.

The overall VST rating of 1.08 is fair for LEVI. So, does poor upside potential and safety outweigh excellent timing, or is it the other way around? VectorVest rates this stock a BUY right now - learn more about this opportunity with a free stock analysis before it’s too late!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. LEVI jumped 15% Thursday morning after the jeans maker reported solid Q1 earnings alongside a slight boost to its full-year outlook, all driven by DTC improvements. The stock itself has poor upside potential and safety, but excellent timing earns it a BUY recommendation.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment