On Tuesday after the market closed, Wells Fargo & Company (WFC) released a statement that its board of directors approved an increase to the quarterly common stock dividend – much to the delight of investors.

The company was already paying a quarterly dividend of $0.30, but the company has raised that up to $0.35 for a modest bump. This dividend will be payable on September 1st, 2023 to all shareholders of record on August 4, 2023.

The dividend news alone would have been enough to stir excitement – but it gets better. Wells Fargo’s board also approved a whopping $30b stock repurchase program. The company will be able to buy back stock at will based on its own internal capital adequacy framework, which takes into account market conditions, changes to regulations, and other pertinent risk insights.

CEO Charlie Scharf expressed on behalf of the company that the number one priority remains unchanged: investing in risk and control infrastructure. That being said, there will be an increased focus on creating updated opportunities for customers while supporting employees and communities.

Scharf also said that despite these substantial investments, Wells Fargo maintains robust capital levels – and that won’t change anytime soon. So, this is the perfect time to return excess growth back to shareholders.

WFC popped just 2% on the news, turning around what was looking to be a concerning trend forming – as the stock was down nearly 2% in the last week before yesterday’s statement. Prior to that, though, the stock had been rallying in the right direction for a month, up more than 13% in the last 30 days.

That being said, this seems like your signal to buy – but not so fast. Before you make your next trade, you’re going to want to see what we’ve uncovered for WFC using the VectorVest stock analyzer…

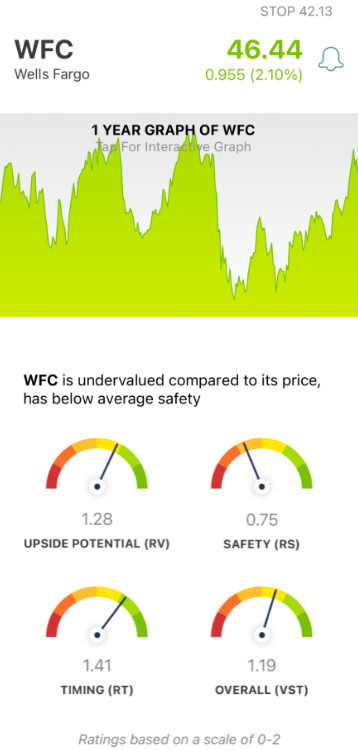

WFC May Have Poor Safety, but the Stock Has Very Good Upside Potential and Very Good Timing

The VectorVest system helps you fine-tune your investing strategy, empowering you to win more trades with less work. How? Simple - you’re given all the insights you need in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each of these ratings sits on an easy-to-interpret scale of 0.00-2.00, with 1.00 being the average. But it gets even easier. Because based on the overall VST rating for a given stock, the system issues a clear buy, sell, or hold recommendation - based on real-time data. As for WFC, here’s what you need to know:

- Very Good Upside Potential: The RV rating draws a comparison between a stock’s long-term price appreciation potential (projected 3 years out) and AAA corporate bond rates & risk. And right now, WFC has a very good RV rating of 1.28. What’s more, the stock is undervalued at its current price - with a value of nearly $59/share right now.

- Poor Safety: In terms of risk, though, this stock has a poor RS rating of 0.75. This is calculated by analyzing the company’s financial consistency & predictability, debt-to-equity ratio, and business longevity.

- Very Good Timing: Based on the news of an increased dividend and approval of a stock repurchase program, WFC has started climbing back in the right direction, picking up where it left off last week. In saying that, the stock has very good timing right now with an RT rating of 1.41. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year.

All this said, the stock has a good overall VST rating of 1.19 - but is it enough to earn a “buy” recommendation? Don’t play the guessing game or let emotion influence your decision-making. With a free stock analysis at VectorVest, you can gain complete clarity on your next move and make it with confidence.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. After releasing a statement about increased dividends and a stock repurchase program, WFC is an attractive opportunity. While it does have poor safety, the upside potential and timing are very good for this stock right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment