Boeing (BA) shareholders have seen their investments shrink in value over the past year, as the stock has plummeted nearly 50% since December of 2023.

From safety concerns to lawsuits and strikes, the company can’t seem to catch a break – but much of it appears to be self-inflicted as a result of cutting corners.

The latest update in the Boeing saga is playing out today as the company, the International Association of Machinists and Aerospace Workers, and the Federal Mediation and Conciliation Service (FMCS) are convening to work out a negotiation that would end the current work stoppage.

The FMCS has a track record of success in these situations, as it helped resolve the 8+ week strike that took place back in 2008. It’s an independent agency operating under the Federal Government that seeks to help both sides reach an agreement they’re happy with.

While the organization doesn’t have authority to impose a settlement or determine contract terms, experts are optimistic the FMCS can expedite the negotiations – as are all Boeing investors.

Each month that passes will cost $1.3 billion in lost cash flow as the strike persists. This is the last thing the company needs as it’s already burned more cash than it has generated, with a $30 billion deficit since 2019.

The expectation on the Street was that Boeing would finally break even in its free cash flow in the back of this year, and the company was well on track to achieve that – until the strike. Now, the future hangs in the balance.

Boeing is doing whatever it can to stop the bleeding, including a pause on all hirings along with furloughing a large number of executives, managers, and employees here in the US. The plan is for selected employees to take one week of furlough every four weeks until the strike ends.

Back in July we wrote about Boeing buying Spirit Aerosystems in an effort to improve safety. At the time, we advised investors to hold off on buying BA. The stock sat at $185/share. Today, it’s just $156/share.

BA has shed another 10% this month and more than 3% this week alone. At what point do investors have to cut losses and move on? Is this your sign to sell BA? We’ve looked at the situation in the VectorVest stock software and see 3 reasons it might be time.

BA Has Poor Upside Potential, Safety, and Timing

VectorVest is a proprietary stock rating system that gives you all the insights you need to make calculated, emotionless decisions. You can save time and stress while winning more trades.

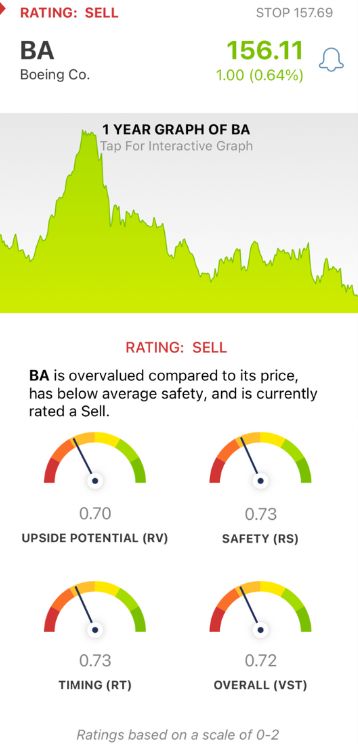

Everything you need to know is distilled into 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT). Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation.

You’re even offered a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for BA, here’s what you need to know:

- Poor Upside Potential: The RV rating is a comparison of the stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. BA has a poor RV rating of 0.70. The stock is overvalued even after falling 40% this year, with a current value of just $63.66/share.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. BA also has a poor RS rating of 0.73.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year, painting the full picture for investors. BA has a poor RT rating of 0.73 as well, reflecting its performance over the short and long term.

The overall VST rating of 0.72 is poor for BA, and the stock is rated a SELL right now. Learn more about why VectorVest says it’s time to cut losses with a free stock analysis today, or review any other stock and discover your next trading opportunity in just a few clicks!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BA is struggling to find its footing after losing more than 40% this year amidst safety concerns, legal battles, and now, strikes and furloughs. The stock itself has poor upside potential, safety, and timing, resulting in a sell warning.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment