The week, and, frankly, the month’s sentiment, will be set by today and tomorrow’s Fed meeting and information on a rate cut. As Americans continue to feel inflationary pressures, the FOMC members’ interpretation of recent inflation data, such as CPI and PPI, will lay the path for when to expect a cut and how severe it could be. With businesses and investors eagerly awaiting answers, let’s dive into how the market’s been anticipating the decision, what to expect, and how the market might react.

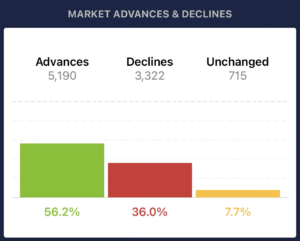

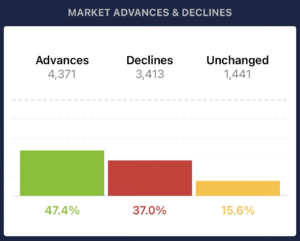

Last week closed in the red, then Monday, March 18th, started the week off in the green due to tech stocks being lifted by Nvidia and market anticipation for the Fed meeting. Tuesday, March 19th, also closed in the green, with the Dow up 320 basis points (+0.83%) and the S&P 500 up 29.09 basis points (+0.56%). The market had a mild presence of advancers to decliners, and things continued to move positively into the next day.

An hour into Wednesday, March 20th’s trading session, the markets continue to barely inch higher, with the Dow up 29.15 basis points (+0.07%) and the S&P 500 up 5.80 basis points (+0.11%). Advancers maintained a minor lead over decliners as the market continued to await the results of the Fed meeting.

What can be expected?

Historically, investors can see the Fed’s decision miles in advance, meaning there will be no rate changes today. In fact, the statement from the January meeting said, “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” and a similar message is likely to be communicated today. The big question, is what will be communicated besides no rate cuts? Timing and amount!

Investors are waiting for a signal on when or how many rate cuts will likely occur in the fiscal year of 2024! Jerome Powell stated in January with “greater confidence” that a March rate cut was not on the table, so that leaves the next option in May, but more likely June. However, today’s meeting could come with more warnings based on the interpretations of inflationary data.

The Fed repeatedly said that they are “data dependent’ and since the January meeting, FOMC members have stated they want to see “a couple more months of easing” before moving forward on cuts. February’s CPI and PPI data reports were better than January’s numbers, but there’s only one more month of potential easing before the next meeting. If those numbers don’t align with the expectations, a June rate cut could be pushed back, and be forced to “wait a few more months” for inflation to cool or the jobs markets to go into hysterics. That decision and analysis will be articulated today, potentially sending the markets reeling.

What will be the market impact?

A few different options could come out of today’s meeting that will result in different impacts on the market. Although there’s no perfect way to predict the Fed’s thought process, their answers will trigger the likely shifts in the markets.

- Unchanged Outlook: An unchanged outlook would be positive for the market, sending it into the green. It means inflation is on track, the economy is responding correctly to easing, everything is within the Fed’s plan, and the nearest rate cut would be in June.

- Early Rate Cut: Unlikely, but if rates are cut early, it’s due to a depreciating job market (Fed speakers continue to state a troublesome job market would trigger an earlier rate cut), and the market would flip out towards the positive with massive gains.

- Delayed Rate Cut: If inflationary expectations are not aligning with the Fed and they want more time to evaluate the data, it means a later rate cut, a red market, and investors scrambling for answers on what to do.

How VectorVest Helps

While the Federal Reserve's decision on interest rates is still up in the air, the market will shift based on what they say. Investors should keenly await the Fed's announcement and execute their targets as appropriate.

For investors unsure of what to do in a volatile climate, it’s time to make informed investment choices. You can do that with VectorVest! staying abreast of Fed announcements and economic data remains essential. VectorVest today provides a definitive answer on maneuvering market sentiment with uncertainty in the wake of the Fed’s decision using data-driven recommendations. These recommendations include potential investments and buy timing while also keeping a thumb on the movements of the overall market.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment