General Motors (GM) reported first-quarter earnings that featured a massive uptick in profitability despite sales challenges here in the US. Shares are up 4% so far today on the news.

The company grew revenue by 7.6% to $43 billion for the quarter, which matched the last quarter’s performance and beat the analyst estimate of $42.09 billion. Earnings per share came in at $2.62/share while the FactSet consensus called for just $2.13/share.

The big takeaway from the quarter was a 25% improvement in net income, as the company didn’t face the same price erosion problems that other US automakers have been battling. Its average vehicle price was down slightly but this was buoyed by strong sales for pickup trucks and other vehicles that have better margins.

GM is optimistic about the remainder of the year given the strong start to 2024, raising its guidance for net income to between $10.1 billion and $11.5 billion. The previous range was just $9.8 billion to $11.2 billion. Meanwhile, adjusted earnings are now forecasted to be between $9 to $10 from $8.50 to $9.50 previously.

This is still accounting for a 2% to 2.5% dip in vehicle prices for the year, but profits won’t take a hit given the 3% increase in pickup truck prices and lower costs for its EV lines. Battery cells and other raw materials are coming down in price.

Meanwhile, EV production as a whole is up given a 300% increase in battery module production for GM. CEO Mary Barra says that it could double its capacity before the end of summer 2024.

GM has been on a torrent pace so far through this year, up nearly 27%. This first quarter performance will only strengthen that trend. So, is it time to buy this stock? We found 3 reasons to consider it in the VectorVest stock analyzer – here’s what you need to know.

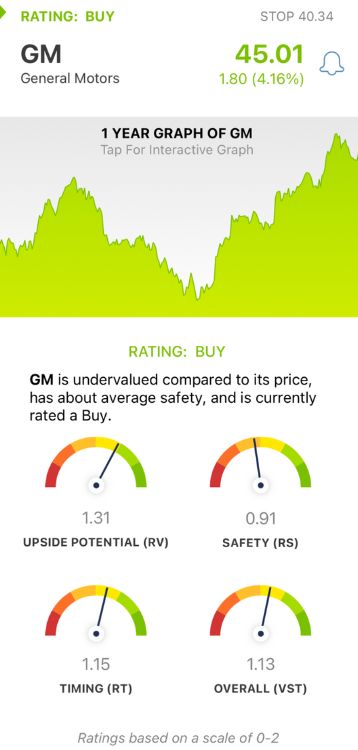

GM Has Very Good Upside Potential, Fair Safety, and Good Timing

VectorVest is a proprietary stock rating system designed to save you time and stress. You’re given all the information you need to make calculated decisions in 3 ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. You’re even given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. Here’s what we found for GM:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It offers a much better level of insight than the typical comparison of price to value alone. GM has a very good RV rating of 1.31. Furthermore, the stock is undervalued with a current value of $59.80.

- Fair Safety: The RS rating is a risk indicator computed from a deep look at the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. GM has a fair RS rating of 0.91, just below the average.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. As you can see from the stock’s recent performance, GM has a good RT rating of 1.15.

The overall VST rating of 1.13 is good for GM. The stock is currently accompanied by a BUY recommendation in the VectorVest system, but you should take a moment to dive deeper with a free stock analysis before you make your next move - don’t miss this opportunity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. GM delivered a solid first-quarter performance that saw profits soar. The stock itself has very good upside potential, fair safety, and good timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment