Dropbox (DBX) delivered a solid first-quarter performance with results surpassing the consensus on the top and bottom lines.

However, one analyst who boasts a 100% success rate trading DBX actually lowered his price target on the stock – and we found 2 reasons ourselves to hold off on this opportunity for the time being.

The company brought in total revenue of $631.3 million, a modest 3% improvement year over year and just ahead of the $629 million analysts were looking for. Meanwhile, profitability got a boost in Q1 too with adjusted earnings per share of 58 cents compared to the 50-cent estimate. This was a 38% improvement year over year.

This performance was driven by growth in paying users for Dropbox, as the company added 35,000 accounts in the quarter compared to the last quarter of 2023. This brought paying users to 18.16 million, up from 17.9 million year over year.

Average revenue per user (ARPU), a key metric for the company, got a slight uptick to $139.59 compared to $138.97 this time last year. Dropbox also announced that its total annual recurring revenue (ARR) grew 3.6% to $2.556 billion.

DBX is up nearly 3% on this news, but is still recovering from a massive dip in mid-February when the stock fell 25% overnight. A 5-star analyst with Goldman Sachs isn’t expecting things to get better anytime soon, either.

Kash Rangan reiterated his SELL stance on this stock and actually lowered the price target from $24 to $22. DBX sits at just under $24/share today, suggesting a slight correction is still to come.

Rangan did give credit to the company’s effort to diversify its platform. However, his main concern is the customers Dropbox relies on (small and mid-sized businesses) are up against a challenging climate right now. He also pointed out the limited upside potential for improvement to ARPU.

We’ve taken a deeper look at DBX in the VectorVest stock analysis software ourselves and found 2 other concerns current or speculative investors need to be aware of.

Despite Good Upside Potential, DBX Has Poor Safety and Timing

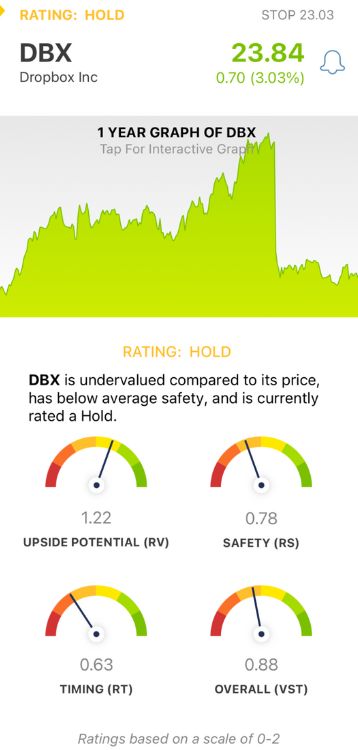

VectorVest is a proprietary stock rating system that saves you time and stress while improving your success rate. It gives you all the insights you need in just 3 ratings - relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average for quick and easy interpretation, effectively eliminating guesswork and emotion from your decision-making.

You’re even given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for DBX, here’s what you need to see:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It offers far superior insights to the standard comparison of price to value alone. We see that DBX has a good RV rating of 1.22 right now. While Rangan sees a 5% downside, the stock appears to be undervalued, with a current value as high as $33.70/share.

- Poor Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. DBX has a poor RS rating of 0.78.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement day over day, week over week, quarter over quarter, and year over year. Reflecting the stock’s performance so far this year, DBX has a poor RT rating of 0.63.

The overall VST rating is a ways below the average at just 0.88, but is still considered fair. However, the stock is rated a HOLD for the time being.

Don’t do anything else before taking the time to assess this opportunity yourself with a free stock analysis - it’s time to transform your trading strategy with VectorVest!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. DBX delivered a solid Q1 performance on both the top and bottom lines - yet, there’s reason to be concerned about the company’s prospects going forward. One analyst who tracks the stock with a 100% success rate actually lowered his price target today. That being said, DBX does have good upside potential despite poor safety and timing.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment