Credo Technology Group (CRDO) is making waves in the market, with its stock soaring nearly 40% after an impressive fiscal second-quarter earnings report that outpaced expectations. The company’s strong performance is driven by the surge in demand for its high-speed connectivity solutions, particularly in the rapidly growing AI and data-center sectors. For Q2 2025, Credo posted a 64% year-over-year revenue jump to $72 million, beating the $66.5 million analysts had forecasted. Adjusted earnings per share (EPS) of $0.07 also exceeded expectations, further boosting investor confidence.

CEO Bill Brennan highlighted that the company had anticipated a turning point in its revenue growth, and it arrived even sooner than expected. He pointed to the growing demand for AI infrastructure as a major factor, which has led to stronger-than-expected customer relationships. Credo’s third-quarter forecast—$115 million to $125 million in revenue—far surpasses analyst estimates, reflecting continued momentum and optimism.

In 2024 alone, Credo’s stock has surged almost 250%, a testament to the market’s positive outlook. While the company posted a net loss of $4.2 million for the quarter, the $0.07 adjusted EPS shows strong operational efficiency. The 88% increase in product sales, alongside promising growth in engineering services, positions Credo well for the future as demand for AI-related infrastructure continues to rise. With a strong pipeline ahead, the company’s outlook remains bright, and its stock price is riding high, hitting an all-time peak of $65.38 in pre-market trading.

CRDO Has Fair Upside Potential and Safety with Excellent Timing

VectorVest is a proprietary stock rating system that simplifies stock analysis into three clear ratings, making it easier to make calculated investment decisions. The system has consistently outperformed the S&P 500 index over the last 20 years, delivering actionable insights based on relative value (RV), relative safety (RS), and relative timing (RT).

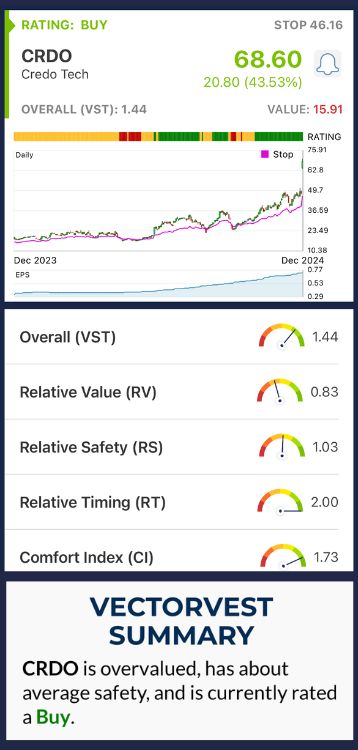

These ratings sit on a scale from 0.00-2.00, with 1.00 being the average, allowing for quick and easy interpretation. Additionally, VectorVest provides a buy, sell, or hold recommendation based on the overall VST rating for any stock. Here’s what we found for CREDO (CRDO):

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year forecast), AAA corporate bond rates, and risk. The RV rating for Credo stands at 0.83, suggesting fair long-term growth potential.

- Good Safety: The RS rating assesses the company's financial consistency, debt-to-equity ratio, business longevity, and other factors. With an RS rating of 1.03, Credo’s financial stability and predictability are fair, indicating average risk.

- Excellent Timing: The RT rating measures the stock’s price momentum, looking at short-term price movements.Credo’s rating of 2.00 is exceptional, reflecting the stock's strong price momentum and positive market sentiment. Credo’s recent 40% surge in share price and continued growth prospects indicate very favorable timing for the stock.

With an overall VST rating of 1.44, Credo Technology Group earns a BUY recommendation. While the stock has good upside potential and strong momentum, its safety is not as robust as its timing. Still, investors should consider the stock’s growth trajectory driven by the AI boom, especially with its impressive guidance for future quarters.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks that are rising in price. CRDO has shown impressive upside potential, with its stock surging 37% following a strong earnings report. Despite its strong timing, driven by growing demand in the AI sector, CRDO faces challenges related to its relatively low safety score. The company is still navigating a competitive market and is exposed to volatility, which makes it a more speculative investment at the moment. While the growth outlook remains promising, its lower safety and moderate risk require careful consideration for investors.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment