Shares of Bumble (BMBL) are up 2% after a roller coaster ride this morning. The stock initially tumbled 8% in pre-market trading before climbing 7% when the market opened. All of this is a result of the company delivering a third-quarter earnings update that fell short of expectations.

Bumble, the online dating and networking app, expects revenue for the quarter ending in December to fall somewhere between $272 million and $278 million. Analysts were hoping to see at least $285.9 million. The company’s full-year outlook was also underwhelming.

This news comes just one day after Whitney Wolfe Herd, former billionaire, announced that she would be stepping down as CEO on January 2nd, 2024. Lidiane Jones will take the wheel and hopefully steer the company back in the right direction. Jones is currently the CEO of Slack.

Wolfe Herd has been serving as CEO since long before the company went public back in February of 2021. She founded the company almost 10 years ago and has worked hard to create a space where genuine connections can be made. While Bumble boasts countless success stories, the stock itself is not one of them.

The stock was able to reach an all-time high of $78.89 quickly upon being listed, but it’s been a slippery slope down to the $13.78 it sits at today. The stock has lost more than 80% of its value in just over 2 years.

Aside from the internal turmoil Bumble is facing, the app is in a competitive market where it’s not even considered the top dog amidst other platforms like Tinder and Hinge, which are owned by the same company – Match Group Inc. That being said, these apps are facing similar challenges to Bumble in terms of growth.

So, what should current BMBL investors do with this situation – is it time to buy more shares as they appear to be rallying back in the right direction? Should you cut losses before things get worse?

We’ve taken a look through the VectorVest stock analysis software and have uncovered 3 things you need to see before you do anything else.

Despite Fair Upside Potential, BMBL Has Poor Safety and Timing

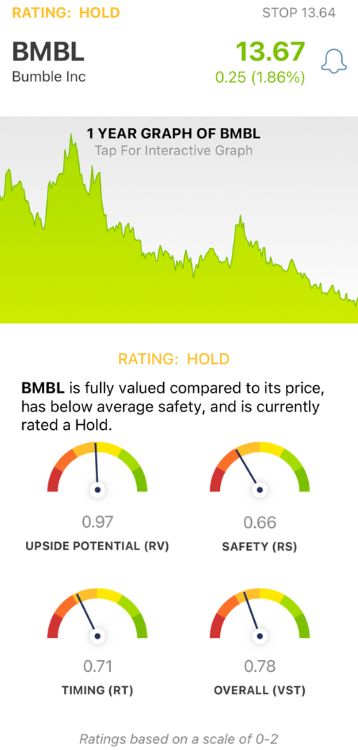

VectorVest is a proprietary stock rating system that has outperformed the S&P 500 index by 10x over the past few decades and counting. It’s all based on three simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

These ratings sit on a simple scale of 0.00-2.00 with 1.00 being the average. You’re even given a clear buy, sell, or hold recommendation based on the overall VST rating for a given stock at a given time. As for BMBL, here’s what we’ve uncovered:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out) to AAA corporate bond rates and risk. BMBL has an RV rating of 0.97, which is just below the average but considered fair nonetheless. The stock is fully valued at this time.

- Poor Safety: The RS rating is an indicator of risk. It’s calculated through an analysis of a company’s financial consistency & predictability, debt-to-equity ratio, business longevity, price volatility, sales volume, and other factors. BMBL has a poor RS rating of 0.66.

- Poor Timing: Despite gaining more than 3% in the past week, BMBL has a poor RT rating of 0.71. This rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year.

The overall VST rating of 0.78 is poor for BMBL, but it’s not quite enough to justify cutting losses on this stock yet. VectorVest rates this stock a HOLD for the time being, but the situation is developing rapidly so stay up to date with a free stock analysis now!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BMBL gave a grave outlook after announcing that its founder and CEO would step down in 2024. The stock has fair upside potential but poor safety and timing holding it back right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment