Shares of Boeing (BA) moved more than 2% lower Wednesday amidst concerns that the company could be in more legal trouble.

This time, the Department of Justice (DOJ) has said that the company could face prosecution for breaching a contract that was put in place to avoid legal trouble associated with the fatal 2018 and 2019 737 Max plane crashes.

This deal was coupled with $2.5 billion in fines after the company was accused of misleading regulators who approved the plane in question.

It featured an automated flight control system known as MCAS which went rogue shortly after take-off on two separate occasions – one in Indonesia and one in Ethiopia. The system repeatedly and forcefully pushed the nose of the plane downward, resulting in more than 346 innocent lives being lost.

This agreement was reached in 2021 and required Boeing to design, implement, and enforce a compliance and ethics program in an effort to avoid and identify US fraud violations.

The recent debacle regarding the door panel blowing out on an Alaska Airlines flight has put Boeing under a microscope with federal regulators including the DOJ. Just a few months back we wrote about this issue and how BA was rated a SELL in the wake of the news.

The next step will be a meeting between the DOJ and family members of those who lost their lives on Boeing planes in the next few weeks. After that, we’ll have a better understanding of how prosecutors intend to proceed.

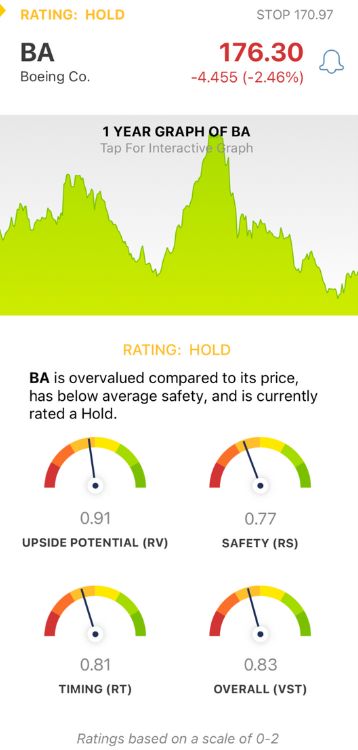

In the meantime, what should BA investors do? The stock sat at around $190 last time we wrote about it, but today, it’s just $176/share. So, is BA still a SELL? We’ve taken an updated look through the VectorVest stock analysis software below and found 3 things you need to see…

BA Still Has Fair Upside Potential With Poor Safety and Timing

VectorVest is a proprietary stock rating system designed to save you time and stress while empowering you to win more trades. You’re given all the insight you need to make calculated decisions in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average. This makes interpretation quick and easy - but it gets even better. The system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for BA, here’s what we’ve uncovered:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It offers far superior insight than the typical comparison of price to value alone. BA has a fair RV rating of 0.91, but it’s overvalued. The current value for this stock is just $85/share.

- Poor Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. BA has a poor RS rating of 0.77 now.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. BA had begun turning things around until today’s news, up 5% in the past month. This rating improved from a few months ago, but it’s still poor at 0.81.

The overall VST rating of 0.83 is poor for BA, but not quite enough to justify selling this stock yet. VectorVest has it rated a HOLD for the time being.

That being said, you’re going to want to take a closer look if you’re a current BA investor or are looking for an opportunity to trade this stock. Get a free stock analysis today and make your next move with complete confidence and clarity!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. BA is down more than 2% today on news that it could be in hot water with the DOJ regarding two fatal crashes from more than 5 years ago. The stock itself has fair upside potential, but safety and timing are poor right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment