Shares of Advanced Micro Devices (AMD) are up more than 11% this week after the company announced its acquisition of ZT Systems. Acquiring the AI infrastructure provider is a strategic move that will boost the chip maker’s bottom line in 2025.

ZT Systems is a New Jersey-based company that offers a range of solutions, from complex computing to storage and accelerators. The company is trusted by the likes of Amazon and Microsoft and brings in annual revenue of around $10 billion. The deal with AMD is valued at roughly $4.9 billion.

CEO of AMD, Lisa Su, said the acquisition will empower her company to sell more GPUs. It will start by selling off the ZT server manufacturing business after a spin-off to avoid competing with SMCI, remaining focused solely on the AI chip market. The top priority is to catch up to Nvidia.

This is the second acquisition for AMD in the past few weeks, as it just announced a deal to buy a private AI lab in Europe known as Silo AI. This smaller deal will cost around $665 million.

All of this comes off the heels of an exciting summer that saw the company roll out an array of new products – like the MI325X accelerator and Ryzen AI 300 processor. There is more to come in the year ahead still, too.

After a successful Q2 that saw both an earnings and revenue beat, AMD is expecting to grow revenue to $6.7 billion, a 16% growth year over year, for the third quarter.

Analysts are currently divided on what the ZT Systems deal could mean for the company, though. BofA maintained its buy rating with a $180 price target, while Wedbush analysts have taken a more optimistic stance with a price target as high as $200.

The stock currently sits at just $157 per share, but the trend we’ve seen form this week is certainly a step in the right direction. So, is now a good time to buy AMD?

Not so fast. We’ve taken a look at this opportunity in the VectorVest stock forecasting software and found 3 things you need to see before you do anything else.

AMD Has Excellent Upside Potential and Safety With Fair Timing

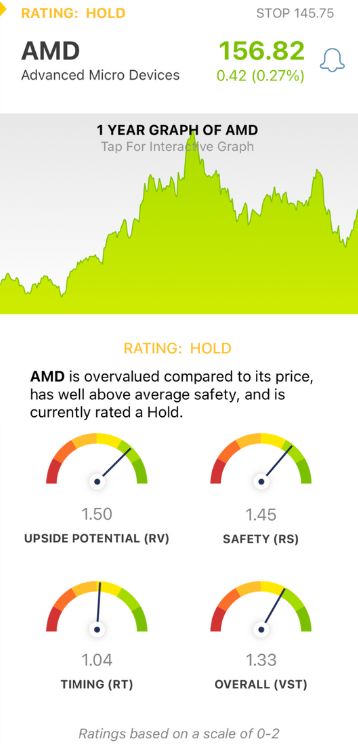

VectorVest is a proprietary stock rating system that saves you time and stress in your analysis while empowering you to win more trades. It gives you all the insights you need in 3 simple ratings: relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on an easy-to-interpret scale of 0.00-2.00 with 1.00 being the average. Better yet, you’re given a clear buy, sell, or hold recommendation based on the overall VST rating for any given stock at any given time. Here’s what we found for AMD:

- Excellent Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a much better indicator than the typical comparison of price to value alone. AMD has an excellent RV rating of 1.50.

- Excellent Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.45 is excellent for AMD.

- Fair Timing: The RT rating assesses a stock’s price trend. It’s based on the direction, dynamics, and magnitude of a stock’s price movement day over day, week over week, quarter over quarter, and year over year. Although AMD has been moving in the right direction in the past few days, the RT rating of 1.04 is just fair.

The overall VST rating of 1.33 is very good for AMD, but not enough to earn it a buy just yet. The stock is currently rated a hold. However, if the price trend we’ve seen form over the past few days continues, that could change.

So, take a moment to dig a bit deeper with this free stock analysis and make sure you’re ready to capitalize when the timing is right. Transform your trading strategy for the better today!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. AMD is up 11% in the past week after announcing another AI acquisition. The stock itself has excellent upside potential and safety, but its timing is just fair right now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment