Shares of Adobe (ADBE) are down more than 14% Friday morning after the company delivered its first-quarter earnings for fiscal 2024. The company delivered on earnings, but its outlook for the quarters to come left much to be desired and spurred negative investor sentiment.

Adobe’s results included an 11% growth in revenue to $5.18 billion, which outpaced the $5.14 billion Wall Street was expecting, along with the company’s own guidance of $5.15 billion at the top end.

Meanwhile, adjusted earnings per share came in at $4.48, again, outperforming the $4.38 analysts were looking for along with the company’s own range of $4.35 to $4.40. The company ended the quarter with $6.82 billion in cash.

The company urged shareholders to focus on adjusted results for the first quarter, as the GAAP figures paint a vastly different picture. These include the massive costs of failing to acquire Figma, which was squashed by the European Commission and the UK Competition and Markets Authority last year.

Adobe repurchased 3.1 million shares of its stock in the first quarter and announced that it intends to keep that momentum going. Its board just authorized another $25 billion in common stock repurchasing.

While the first quarter was solid, the second quarter appears to be a letdown already. Q2 guidance is what really stole the spotlight and sent shares downhill.

The company is poised to underwhelm on revenue with a guidance of $5.25 billion to $5.3 billion. This would mean up to 10% growth year over year, but Wall Street is looking for $5.31 billion.

That minor discrepancy is all it takes to spark negative investor sentiment when everything else appears to be going right. While long-term investors have nothing to worry about, it’s still worth begging the question…is this reason enough to sell ADBE in the short term?

We’ve taken a look through the VectorVest stock software and have 3 things that will help you make your next move with confidence and clarity.

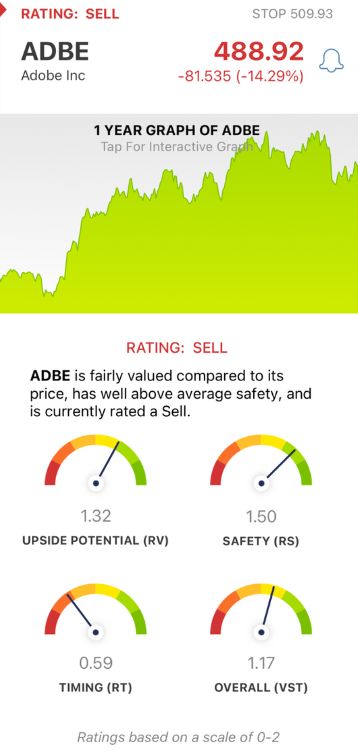

ADBE Has Very Good Upside Potential and Excellent Safety, But Poor Timing is Holding the Stock Back

VectorVest simplifies your trading strategy by giving you clear, actionable insights in 3 proprietary ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on its own scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. It gets even easier, though.

The system issues a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for ADBE, here’s what we’ve uncovered:

- Very Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (based on a 3-year price projection), AAA corporate bond rates, and risk. It paints a far more detailed picture than a simple comparison of price to value alone. ADBE has a very good RV rating of 1.32 right now.

- Excellent Safety: The RS rating is a risk indicator. It’s derived from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, and price volatility. The RS rating of 1.50 is excellent for ADBE.

- Poor Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s taken day over day, week over week, quarter over quarter, and year over year. This is the one thing holding ADBE back - a poor RT rating of 0.59.

The overall VST rating of 1.17 is good for ADBE, but the negative price trend pushing this stock lower and lower has resulted in a SELL recommendation within the VectorVest system.

Learn more about this situation before you do anything else - get a free stock analysis today and transform your trading strategy for the better!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ADBE is down 14% so far Friday despite delivering solid Q1 earnings results, as conservative guidance for Q2 compared to the analyst consensus sparked investor disdain. While the stock does have very good upside potential and excellent safety, poor timing is holding it back.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment