Shares of Accenture (ACN) are up just under 6% in the past week amidst hype for the company’s AI-powered performance in the fourth quarter.

The business management consultant posted adjusted earnings per share of $2.79, which matched the analyst consensus. Revenue of $16.41 billion was a 2.6% improvement year over year and ahead of the estimate for just $16.39 billion.

This earnings beat was fueled by a surge in new bookings for generative AI specifically. The company saw new bookings across the board spike 21% to $20.1 billion, while AI bookings in particular finally reached $1 billion in Q4. This brings AI bookings to $3 billion for the fiscal year.

CEO Julie Sweet feels confident about Accenture’s position in the AI arms race, saying the company showed that it’s a clear leader in Generative AI – which she referred to as the most transformative technology this decade.

Looking ahead to fiscal 2025, Accenture is forecasting full-year earnings per share of $12.55 to $12.91. Analysts are expecting $12.70, more or less at the mid-range of the company’s guidance.

The company also used this performance to fuel a dividend increase to $1.48 per share, which is a 15% bump. Shareholders of record on October 10th will be paid on November 15th.

Meanwhile, the company’s board gave the green light to move forward with another $4 billion in stock repurchasing power, which brings the total to $6.7 billion.

The stock is currently up less than 2% on the year, but has gained more than 16% over the past three months. ACN fell hard in the first half of the year but has turned things around since the end of May.

So, where does all this leave you as a current investor or someone interested in trading ACN? We’ve taken a look at this opportunity in the VectorVest stock analysis software and found 3 things you need to see.

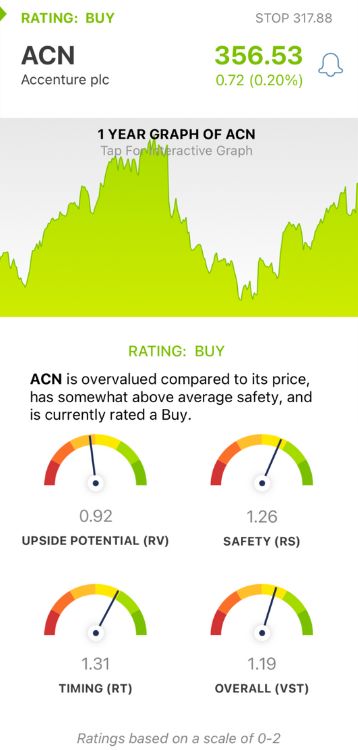

ACN Has Fair Upside Potential With Very Good Safety and Timing

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it. It eliminates emotion and human error while empowering you to win more trades with less work and stress.

You’re given all the insights you need to make calculated investment decisions in 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each sits on a scale of 0.00-2.00 with 1.00 being the average, allowing for quick and easy interpretation. It gets even better though. You’re given a clear buy, sell, or hold recommendation for any given stock at any given time. As for ACN, here’s what we found:

- Fair Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. This makes it a far superior indicator than the typical comparison of price to value alone. ACN has a fair RV rating of 0.92.

- Very Good Safety: The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 1.26 is very good for ACN.

- Very Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating of 1.31 is very good for ACN, reflecting the stock’s performance over the past few months.

The overall VST rating of 1.19 is good for ACN, and it’s currently rated a BUY in the VectorVest system. But before you make that next move, take a closer look at this opportunity with a free stock analysis so you can fully capitalize. You’re not going to want to miss this one!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. ACN continues to climb higher after reporting impressive Q4 results to end the year strong, along with more stock repurchasing power and a higher dividend to sway sentiment even further in the right direction.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment