You may recall the weekly Essay entitled “Buy Now Pay Later” on 17 July 2020 or the Essay on 16 July 2021 entitled “Afterpay and Its Looming Competition.” Buy Now Pay Later (BNPL) stocks were running hot back in 2020 through 2021. Since 2021, Afterpay (APT.AX when it was listed) was acquired by Block Inc (SQ2.AX).

How does the BNPL market currently look in Australia? To find out, head over to the Viewers tab and from there open the WatchList Viewer. Open the Overview WatchLists group and then click on the WatchList entitled: BNPL Stocks. Currently, 3 NBPL stocks are being tracked: ZIP.AX, HUM.AX and QFE.AX.

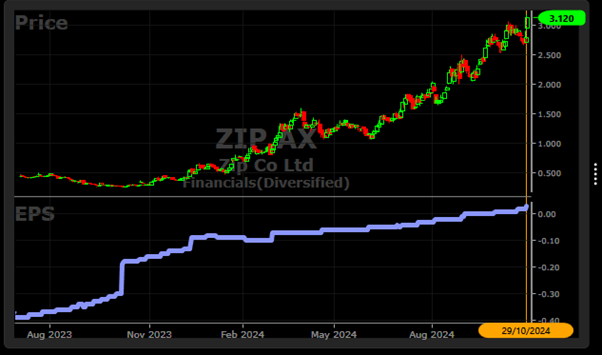

Right click on the bottom line (per the WatchList Average) and select: View WatchList Average Graph. This allows for you to view the average of all 3 of the listed BNPL stocks. In the example below, we have the average price and the average earnings (EPS) across the 3 stocks:

Notice from 2020 through to mid-2023, EPS was declining! The rally in 2020 through 2021 was never going to be sustainable on a falling EPS. However, notice how EPS started rising toward the end of 2023 through to October 2024.

Back in 2020 when we first wrote about BNPL, we saw a boom followed by a bust in the BNPL industry. The Essay back on 17 July 2020 noted for one to be careful due to the declining EPS profiles (which was covered in the video that accompanies that Essay). You may wish to look up the Essay and view the video (per the Views tab you can view the historical weekly Essays).

For the WatchList average in 2024, EPS is rising across ZIP.AX, HUM.AX and QFE.AX, however, the Relative Safety (RS) scores for the 3 noted companies are still average to below average. RS looks at the consistency and reliability of a given stock’s financials. Should EPS continue to power higher in the months to follow, RS will pick up. We may very well be in the early stages of witnessing three BNPL stocks that could surge in price should a positive BNPL narrative continue to play out.

Per the BNPL WatchList, ZIP.AX stands out as of October 2024. The most recent 1Q FY25 results for ZIP.AX noted that earnings were up 233.7% from the previous quarter along with revenue up 18.8% along with transactions processed by ZIP.AX up over 18.1%.

Will the BNPL industry hold up this time? EPS at present makes a strong case for the sustainability of the rally this time round. Log into VectorVest each day to check the EPS profiles.

Residents of Australia:

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment