GOLD ETFS TRACKING HIGHER.

No matter how we cut, slice and dice the analysis these days, ETFs have been a real standout for 2024. As of September 2024, Gold ETFs listed on the Australian Stock Exchange (ASX) have performed well since the start of 2024.

Theory notes that Gold is a defensive asset class and gold prices benefit in uncertain economic times. Some of the factors surrounding uncertainty in the market include:

- The upcoming US Election.

- Ukraine/Russia and Israel/Palestine wars.

- Inflation, interest rates and economic growth outlook.

- A lack of forthcoming rate cuts for the US and Australia among other nations.

Several nations have increased their stockpiles of gold, is this due to the economic uncertainty? China has been buying gold aggressively, with China’s central bank said to have acquired 735 tonnes of gold in 2023, the most gold bought of any central bank in the world for 2023 and we await to find out what the totals will be for 2024. Should we as investors be looking more closely at gold too? For this week’s Essay, we are going to concentrate on 6 Gold ETFs.

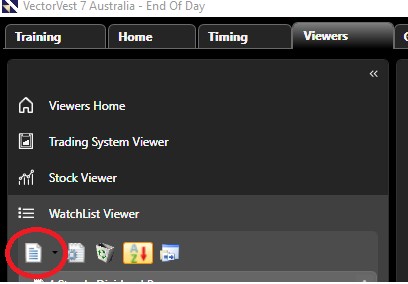

The 6 Gold ETFs (as listed on the ASX) tracked by VectorVest each day are as follows: GDX.AX, GOLD.AX, MNRS.AX, NUGG.AX, PMGOLD.AX and QAU.AX. To analyse the ETFs, setup a WatchList of the 6 listed Gold ETFs. To do so, click on the Viewers tab on the main toolbar, then click on the WatchList Viewer.

From there, select the My WatchLists group. Then click on the dropdown arrow next to the icon that has the page with the top right corner bent down:

Select: New WatchList and name accordingly. Once you have the WatchList setup, add in the 6 ETFs where it notes: Add Symbol(s). Enter in each ETF (don’t forget to put in .AX after each ticker code).

Next, at the bottom of the WatchList page, right click on the WatchList Average Line and then select: View WatchList Average Graph. As of 3 September 2024, the WatchList average of the 6 noted ETFs appears as follows:

Put on both Relative Timing (RT) and the Comfort Index (CI) on your graph, note how RT broke above 1.00 on 16th of February 2024 and has not fallen below 1.00 as of 3rd of September 2024. RT looks at short-term price momentum on a scale of 0.00 to 2.00. Also note, CI broke above 1.00 on the 28th of March 2024 and continues to power higher per the image above. A high CI score depicts an ETFs ability to resist severe and/or lengthy price declines. CI is on a scale of 0.00 to 2.00.

If you take the first date of 16 February 2024 where RT broke above 1.00, the QuickTest returns to 3 September 2024 are as follows:

If you QuickTest the WatchList from 28 March 2024 through to 3 September where CI broke above 1.00 per the WatchList average, it returns over 13%.

Should the economic uncertainty continue in the short-term, Gold ETFs stand to benefit. Keep an eye on Market Timing to see how the market plays out along with the given Gold ETFs.

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment