The power of Relative Safety (RS) does it again.

The market has started the year with volatility. So how do we ride out this volatility? One of the methods we apply at VectorVest is to find stocks with strong financial consistency and predictability. RS is the very indicator that looks into company financial consistency and performance. As part of your stock selection strategy, stocks with high RS scores are favored over those with lower scores. RS is on a scale of 0-2. The higher the score the better. A score of 1.40 is exceptional. Only two stocks met that criteria on 2 January this year.

If you go to stock viewer and sort all the stocks by RS in descending order and set the date back to the start of the year, you will bring up the following stocks (note Corporate Travel in that mix, one of our 3 SuperStar stocks – click here for that post):

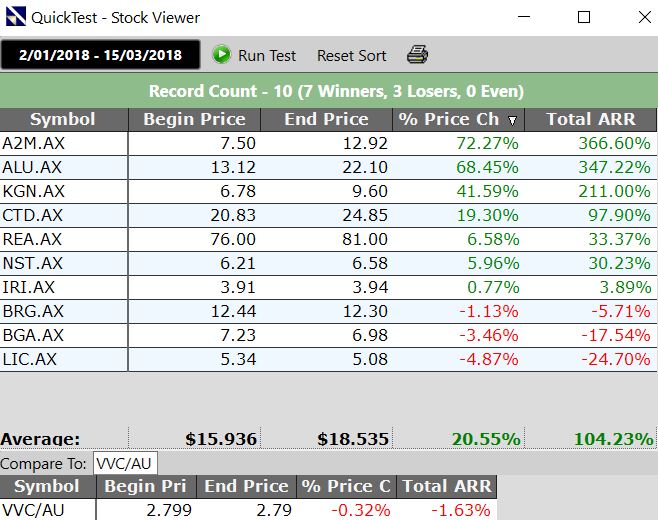

If I take these top ten RS stocks as of 2 January and QuickTest from 2 January 2018 to 15 March – I get:

Top RS stocks are often the very stocks that have earnings powering on higher and higher as after all, stocks with consistent financials are more likely to be stocks with consistent rising earnings.

The power of RS proving itself in volatile markets!

Leave A Comment