Hi everyone,

I recently visited Adelaide and Perth to attend the Australian Shareholders Association’s Big Day Out. While I was in Adelaide and Perth – I attended the user groups there. I had been asked to prepare a presentation on how to find top dividend paying stocks. The presentations went down well, so I decided to also bring this up in my recent Q&A session.

A few of you have asked me for the recording – so please find it attached per below:

CLICK HERE TO ACCESS THE VIDEO

In this recording, I show you how you can setup parameters to find some of the best dividend paying stocks in such a way that you feel comfortable with not only the dividend paying prospects, but the potential capital appreciation of the stock too. No point getting good dividends if the stock fall by more than the dividends paid!

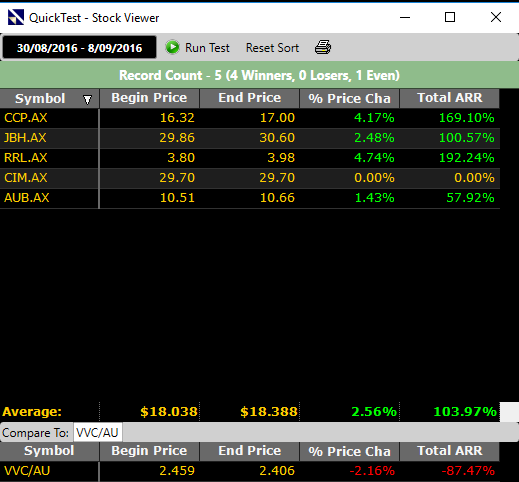

Just before I submitted this blog post – I wanted to go back to the video and double check the dividend stocks identified – to see how the fundamentals were stacking up in the current market pullback:

Not too bad – the idea behind the presentation was to find top dividend paying stocks that are a bit more resilient . This certainly does not constitute a buy and hold strategy – but interesting to see how these stocks holding up in current market conditions.

Regards,

Russell.

DISCLAIMER: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. YOU SHOULD CONSULT WITH YOUR LEGAL, TAX, FINANCIAL, AND OTHER ADVISERS PRIOR TO MAKING AN INVESTMENT WITH VECTORVEST

Leave A Comment