Tesla Inc. (TSLA) shares surged 7% Monday morning, following news that President-elect Donald Trump’s transition team is working on a federal framework to regulate self-driving vehicles. The news could be a major boost for Tesla’s autonomous driving ambitions, especially with the recent unveiling of Tesla’s “Cybercab” prototype.

The stock’s rally follows a report from Bloomberg, which indicates that the Transportation Department plans to prioritize the development of self-driving regulations, a move that could help Tesla accelerate its efforts to bring fully autonomous vehicles to market. Tesla has long touted autonomous driving as a core element of its future, and this regulatory push could be the catalyst the company needs to realize its vision of robotaxis by 2026.

In addition to the regulatory news, Tesla has benefitted from its close relationship with Trump, which has raised hopes among investors that the company will see more favorable treatment in the coming years. Wedbush analyst Dan Ives estimates that the autonomous driving opportunity alone could add $1 trillion in value for Tesla.

However, despite the positive momentum, the stock still has some underlying challenges. Tesla’s road to fully autonomous vehicles has faced numerous setbacks, and the company must navigate complex regulatory hurdles. While some analysts are bullish about the stock’s future prospects, others remain cautious.

So, is it time to buy TSLA after this 7% pop? We’ve taken a closer look at the stock through the VectorVest stock forecasting software, and here’s what you need to know.

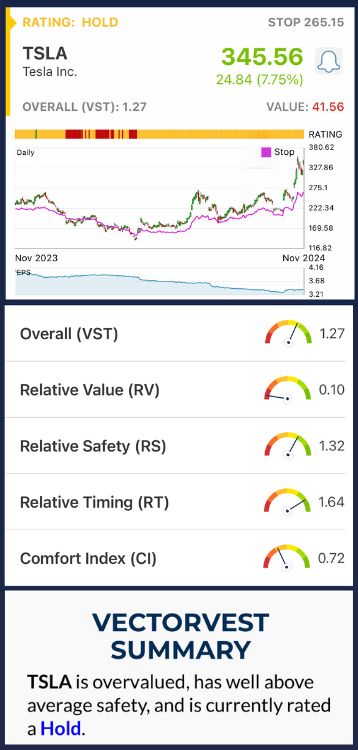

TSLA Has Very Poor Upside Potential With Excellent Safety and Fair Timing

VectorVest is a proprietary stock rating system that distills complex technical and fundamental data into clear, actionable insights. Here’s the breakdown for TSLA based on the latest news:

- Very Poor Upside Potential: The RV rating compares a stock’s long-term price appreciation potential to AAA corporate bond rates and risk. It’s a far superior indicator than the typical comparison of price to value alone. TSLA has a very poor RV rating of 0.10.

- Excellent Safety:The RS rating is a risk indicator. It’s computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. TSLA’s RS rating of 1.32 reflects very good safety, signaling that the company has a solid track record of financial consistency and a relatively low level of risk.

- Fair Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. The RT rating for TSLA is 1.64, indicating excellent timing, with the stock showing strong momentum in its price movement.

The overall VST rating for TSLA is 1.27, which is very good, but the stock is still rated a Hold at the moment due to the low upside potential.

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. While TSLA saw a nice jump after the news on self-driving regulations, the stock remains overvalued with very poor upside potential. Its excellent safety and timing make it a solid hold for now.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment