WHEN WILL INTEREST RATES BE CUT?

Cuts in Australian interest rates and when these are likely to take place have been a topic of much discussion between analysts and investors this year.

Until inflation, as measured by the Consumer Price Index (CPI), is brought into the Reserve Bank of Australia’s (RBA) target band of 2 – 3%, uncertainty and speculation in the interest rate outlook will persist. This is not helped by inflation proving to be “sticky,” not falling fast enough to allay the RBA’s concerns.

The last quarterly inflation reading was 3.6% in April 2024, with the next report on 31 July 2024, and many hoping a further fall in inflation will be enough for the RBA to signal its intentions regarding lowering interest rates.

High interest rates negatively impact the economy. Projects get delayed, new business ventures are put on hold and overall economic activity slows down. In particular, retail sales have been impacted for several months now, falling 0.4% in March 2024 (seasonally adjusted) caused by consumers tightening their wallets as higher interest rates bite into their disposable income. If this slowdown runs too deep, a recession is possible. Something the RBA wishes to avoid as it treads a narrow path toward taming inflation without damaging the economy.

Australia’s big four Banks (CBA.AX, WBC.AX, ANZ.AX and NAB.AX) are all forecasting a rate cut this year, possibly in November 2024. The rate cuts cannot come soon enough for many consumers and businesses.

VectorVest has the tools to help its subscribers cut through the noise in the media, enabling them to deal with the relationship between inflation, interest rates and company earnings (earnings, of course, are the driver of share price performance). The graph format of these tools is found by clicking on the Graphs tab on the main toolbar of VectorVest, then clicking on the drop-down selection on the top left of your screen and select Market Climate Graph.

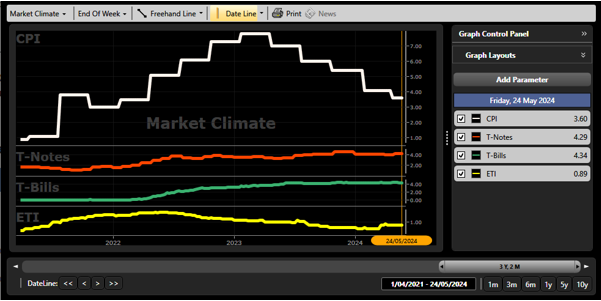

On your graph, add in CPI (inflation) and T-Notes and T-Bills (long and short-term interest rates) by clicking on Add Parameter on the right-hand side of the graph and select accordingly. Make sure you tick the box next to each indicator once you have added them to your graph layout.

As interest rates have risen (as shown by T-Notes and T-Bills), note how inflation has started to come down. Finally, add in our Earnings Trend Indicator (ETI). The ETI is on a scale of 0.00 to 2.00. An ETI score below 1.00 means that the overall trend on earnings is falling across the All Ordinaries, and above 1.00, earnings are rising.

Rising interest rates are bringing inflation down towards the desired 2 – 3% band, but a falling ETI shows this is coming at a cost to consumers and businesses. The challenge for the RBA is to bring inflation back down without stalling the economy too much.

We encourage you to look at VectorVest’s Market Climate Graph regularly to watch the macro picture as it unfolds.

If you would like to trial out VectorVest, take out a trial to VectorVest – CLICK HERE.

Residents of Australia:

VectorVest Inc (ARBN 654 498 218) and Russell Markham are Authorised Representatives (No. 1294036 and No 1294037) of Centra Wealth Pty Ltd (ABN 39 158 802 450) which holds an Australian Financial Services License (AFSL No. 422704). Please refer to our Financial Services Guide which provides you with information about us and services we can provide. Any advice is general in nature and has not considered your personal objectives, financial situations or needs. You should consider whether the advice is suitable for you and your personal circumstances. Backtest results and Model Portfolio performance and profit calculations are theoretical and calculated by VectorVest Inc and do not reflect actual investments in the companies mentioned. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. Actual results may be affected by known or unknown risks and uncertainties that cannot be reasonably included in a backtest, and therefore these outcomes can differ materially from backtested expectations. As a result, past performance should not be relied on as a guarantee for future results.

TERMS AND CONDITIONS: https://vectorvestau.wpengine.com/terms-and-conditions/

PRIVACY POLICY: https://vectorvestau.wpengine.com/privacy-policy/

Leave A Comment