Shares of PayPal (PYPL) have risen roughly 7% in the past week, 5.5% of which came yesterday in the stock’s best performance since the very start of the year.

There are a few things moving PYPL higher: 1) a bullish outlook by the company’s CEO and 2) investor excitement about new products being rolled out by the company.

Alex Chriss, CEO of PayPal, spoke at a Bank of America conference this past Wednesday. He says the company sits at the edge of the largest two-sided ecosystem in the world with a massive opportunity to leverage data and drive lasting innovation.

Chriss went on to reiterate that PayPal remains the go-to player for branded checkout, and there’s still room for the company to get even better. He referenced areas of improvement such as mobile checkout, but sees this segment improving through new product innovations.

His speech led to analyst upgrades from neutral to buy, and it’s not just experts who are excited – PYPL investors are hot on the company’s prospects as well.

While the stock has lagged behind the S&P 500 index over the past year, it’s off to a good start through the first half of 2024. It’s up nearly 10% in that timeframe and nearly 15% in the past month.

That being said, should you buy PYPL today before earnings next month? We took a look through the VectorVest stock software and saw 3 reasons to consider it.

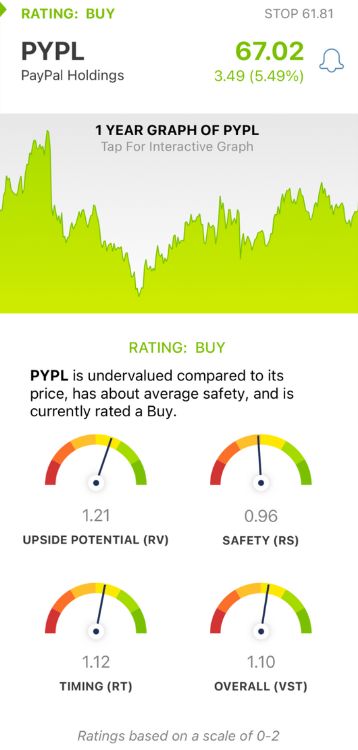

PYPL Has Good Upside Potential and Timing With Fair Safety, Earning the Stock a BUY

VectorVest is a proprietary stock rating system that tells you what to buy, when to buy it, and when to sell it - all in just 3 simple ratings. These are relative value (RV), relative safety (RS), and relative timing (RT).

Each rating sits on a scale of 0.00-2.00 with 1.00 being the average, making interpretation quick and easy. Better yet, you’re given a clear buy, sell, or hold recommendation for any given stock at any given time based on its overall VST rating. As for PYPL, here’s what we found:

- Good Upside Potential: The RV rating compares a stock’s long-term price appreciation potential (forecasted 3 years out), AAA corporate bond rates, and risk. It’s a far superior indicator than the typical comparison of price to value alone. PYPL has a good RV rating of 1.21 right now. Moreover, the stock is undervalued with a current value of $86/share.

- Fair Safety: The RS rating is a risk indicator computed from an analysis of the company’s financial consistency & predictability, debt-to-equity ratio, business longevity, sales volume, price volatility, and other factors. The RS rating of 0.96 is just below the average, but deemed fair for PYPL.

- Good Timing: The RT rating is based on the direction, dynamics, and magnitude of the stock’s price movement. It’s calculated day over day, week over week, quarter over quarter, and year over year. PYPL has a good RT rating of 1.12, reflecting the recent rally this stock has been on.

The overall VST rating of 1.10 is good for PYPL and enough to earn the stock a BUY - but before you do anything else, take a moment to review this free stock analysis and set yourself up for a profitable, stress-free trade!

Want These Types of Insights at Your Fingertips so You Can Win More Trades?

Use VectorVest to analyze any stock free. VectorVest is the only stock analysis tool and portfolio management system that analyzes, ranks and graphs over 18,000 stocks each day for value, safety, and timing and gives a clear buy, sell or hold rating on every stock, every day.

VectorVest advocates buying safe, undervalued stocks, rising in price. PYPL got a lift from neutral to buy and the stock climbed 7% as a result. All this came from a bullish outlook by the company’s CEO and excitement surrounding new products. The stock itself has good upside potential and timing with fair safety.

Before you invest, check VectorVest! Click here to ANALYZE ANY STOCK FREE and see our system in action!

Leave A Comment