Originally written by: Robert and Russell Markham – 13 October 2017

With the improving outlook for international shares, particularly in markets like the USA, Europe, UK and Japan, we have been receiving a lot of questions (in no small measure because of mainstream media attention) about how Australian investors can diversify some of their investments into global markets.

VectorVest provides the tools to invest directly in shares in countries like Canada, Europe, and UK, in addition to Australia. But what if you could get exposure to these and other markets without having to invest outside of the ASX? Is this possible?

The quick answer to this is Yes! Through Exchange Traded Funds (ETFs), which trade just like shares on the ASX, you can get exposure to a number of international markets. Let’s see how VectorVest can help our subscribers analyse and select ETFs to get some diversification into international markets.

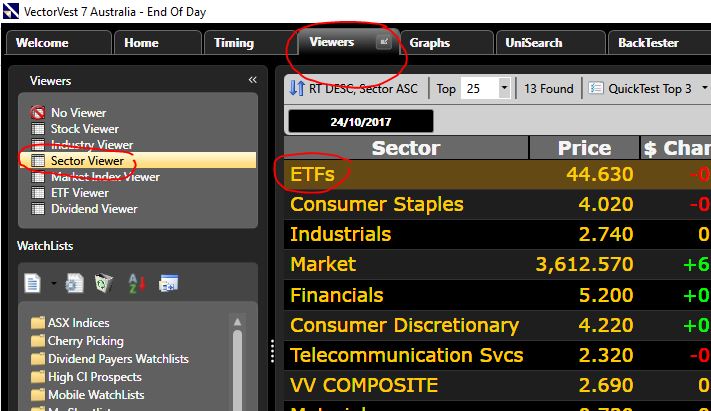

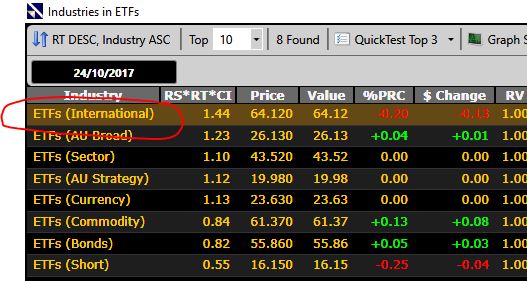

The quickest way to check out ETFs with exposure to international markets is to click on the Viewers Tab on the main toolbar, then select Sector Viewer. In the Sector Viewer, double click on ETFs and then double click again on ETFs (International) to arrive at a list of 55 International ETFs tracked by VectorVest and ranked by VST Desc.

We looked at how ASX listed international ETFs have performed in the last year. To do this, click on the date box and set the calendar back to 3 October 2016. Click on QuickTest Top 5 (make sure the end date in your QuickTest box is set to 9 October 2017) and you will see a 22% gain with all 5 winners. Click QuickTest Top 10 and you will see a 19.08% gain with all 10 winners. Click QuickTest Top 20 and you will see a 16.89% gain with all 20 winners. Click QuickTest Top 30 and you will see a 15.15% gain with 29 winners. Concurrently, the overall ASX represented by the VVC/AU gained only 6.69%

In the past, liquidity has been an issue for many of the ETFs listed on the ASX. This is improving each month, but should be checked out before making a final decision to buy a specific ETF. You can do this by looking at the AvgVol and Volume columns in the Viewer.

If you graph the top international ETF’s you will see some great price patterns. Also, if you’d like to find out more about a specific ETF, you can right click on it, then click on View Full Stock Analysis Report and go to the Business Description (found just below the graphs at the top of the Report).

You may wish to do a similar exercise using VectorVest’s ETF analysis tools to find ways to diversify your portfolio by asset class, industry and sector using ETFs. The possibilities are endless.

Risk-Free Trial

Start a risk-free trial today and start comparing ETF performance and choose the right ETF for your portfolio.

VectorVest Free Stock Analysis

Analyse any Stock FREE and instantly know when to Buy, Sell or Hold.

Leave A Comment